TeleColumbus: Q4 results and 2025 outlook – Bullish thesis intact

TeleColumbus has just reported their 2024 results and provided 2025 guidance for the first time. We remain bullish on the credit story for the company and see increased conviction from the management team on their path to a fibre stronghold in their footprint.

In this note, we provide a detailed review of the results, the balance sheet and the 2025 guidance.

Potential monetisation options for ServCo to unlock value and additional financing routes also remain an option for the company. For more details on that, please see our deep-dive note on those topics from earlier this month.

Detailed review

We are bullish on the TeleColumbus story and we see the bonds as an attractive investment at current levels of 80 (vs. the full face value of c.112 including accruing PIK interest) and we see the Q4 results and 2025 guidance as supportive with no major change to our thesis on the back of these results.

From a credit perspective, the bigger near-term event could be a sale of ServCo, which we believe is the preferred management outcome from the current project to split NetCo/ ServCo. We understand from other potential buyers of the asset that a process is currently underway but unfortunately in the presentation and the call, no new information was given on this topic – as it remains work-in-progress.

We addressed the topic of a ServCo sale in a lot more detail in our recent deep-dive note which we would recommend for further information on this topic. In that note, we also addressed potential other options for new funding other than a ServCo sale, and in today’s results presentation the company does now confirm for the first time that they could be looking at some of these other avenues as well for additional liquidity.

Q4 results review

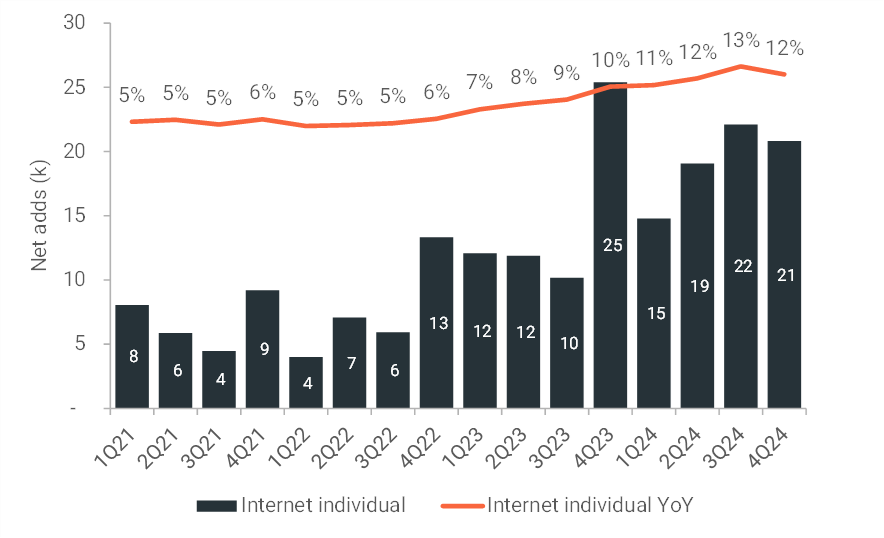

The long-term driver of TeleColumbus’ value creation will come from rising Internet subscribers, and therefore it is encouraging to see that the net adds trends of c.20k/ quarter is being maintained. Therefore, with overall broadband customer growth of 12%/ annum in Q4, this is a very strong performance and their growth rates remain well above their peers in the German market, which are seeing growth rates of just +1 to -2% YoY.

TeleColumbus Internet KPI growth remains very strong

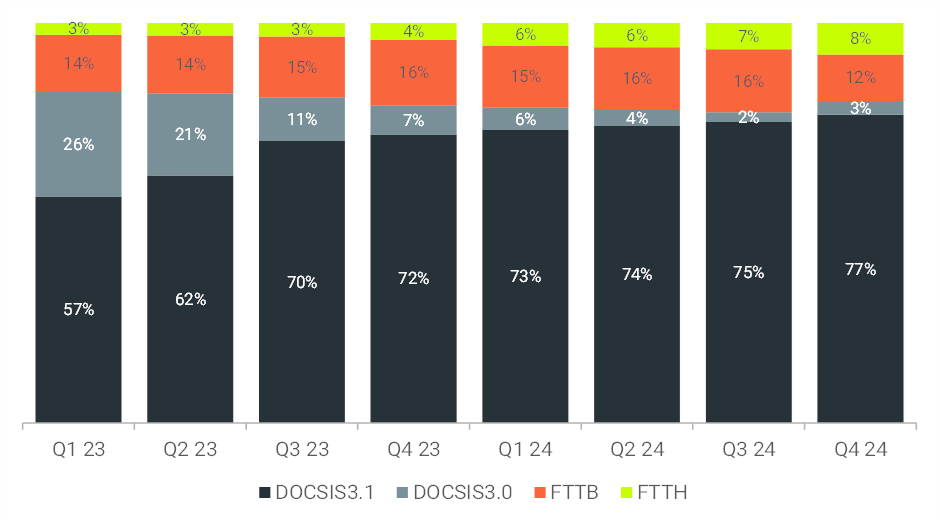

Although the longer-term driver for the story is the migration to FTTH and there is gradual growth coming through in full FTTH connectivity, it is telling to note that most of the current KPI growth they are seeing is still coming from the DOCSIS/ HFC platform.

DOCSIS 3.0 + 3.1 customers have remained broadly stable as % of their Internet base over the past 2 years, and actually increased by 3pp in Q4. Figures like this show how wide the current gulf is between their operating performance and that of Vodafone – which should be able to deliver similar growth levels given a similar asset.

Hence, we still believe that TeleColumbus should be seen as a very attractive acquisition opportunity for Vodafone – not just because it might offer some financial synergies, but largely because it would give them the opportunity to reintegrate the TeleColumbus team – which is clearly demonstrating success – and who largely are ex-Vodafone employees.

The majority of the current growth is still coming from HFC platform

This also raises questions on whether it makes sense for TeleColumbus to actually be building fibre at all, and whether there is a longer-term future to be DOCSIS-only – especially if any capex funding options or deleveraging is difficult to achieve.

Given our view that the MDU FTTH opportunity in Germany offers the unique ability to create a de facto in-building monopoly, we believe the migration to full fibre should allow both for incremental retail growth, and arguably more importantly, the ability to be a winner of wholesale customer growth. The wholesale opportunity is essentially a greenfield opportunity for them given that in 2024, they only did €4m of wholesale revenues from Telefonica on their HFC-only network.

When discussing the FTTH rollout path in Germany in the MDUs, we are therefore very encouraged to see TeleColumbus write in their presentation the following statement:

“Only one fibre provider in the building due to housing association permission/concession”

While we have been writing about this monopolistic characteristic for fibre ourselves for a while and is a key reason why we like the TeleColumbus investment case, we believe that this is the first time the management team has ever put this comment in writing (albeit they have verbalised it before publicly). We see this as an increased sign of confidence in this FTTH framework becoming the norm in Germany.

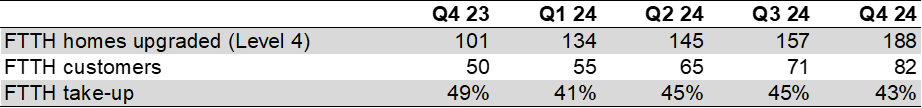

So far though the FTTH deployment story remains slow with just 188k homes connected with fibre, representing 8% of the base. Building out to the base is still likely to be a 10-year story ahead. However, where TeleColumbus deploys fibre, they have been able to see a higher level of penetration of 43% compared to 27% in the non-FTTH connected premises.

Higher level of penetration in FTTH premises

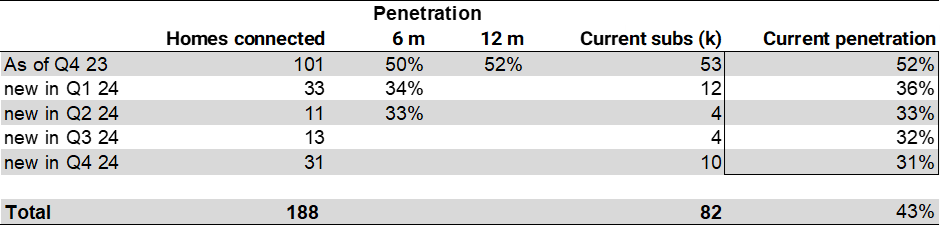

While this looks compelling at a headline level, we do await more information to see how this develops, as this penetration figure is skewed by the FTTH cohort from pre-Q4 23. So far, for the FTTH premises deployed during 2024, we estimate the penetration is in the mid-to-low 30s (with lower take up after 6 months vs. the pre-2024 cohort). This should hopefully grow over time, but will be a KPI to monitor closely going forward to ascertain the real success of the retail fibre story.

Above average penetration skewed by the pre-Q4 23 cohort

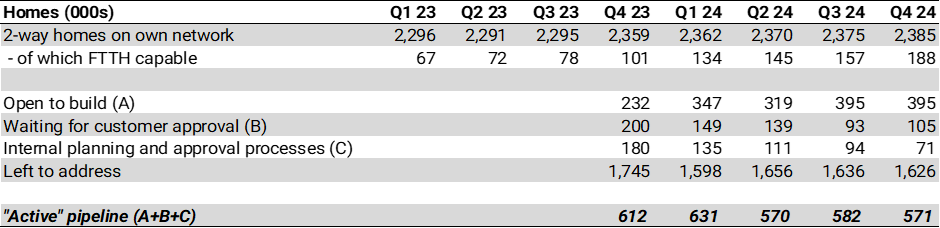

As the FTTH network is being deployed, TeleColumbus is still maintaining the active pipeline of FTTH premises to be deployed at c.600k – albeit the timeframe over which these homes could get connected will still be a lengthy process as the installation timetable is largely determined by the landlords when they are ready for a larger whole-building renovation project. Given the highly effective TeleColumbus sales practices, we continue to be confident that in their footprint area, they should be getting a very high share (c.80%+) of all future premises left to address.

Active pipeline of FTTH homes being maintained

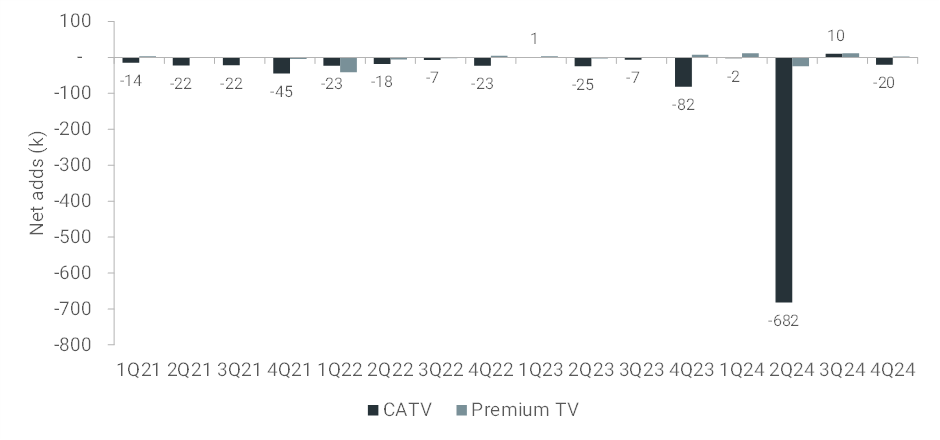

While the KPIs on Internet business look very encouraging, the TV KPIs were a bit weaker than expected as they ended up with 48% of bulk customers retained at end-2024. They are hoping to win back some of the lost bulk customers during 2025 with a final run-rate of 50-55% of the 1.16m bulk TV customers retained. At a 55% retention rate, this would imply the TV base growing back to 1.18m in total by end-2025 from the end-2024 level of 1.10m customers. In our model, we had assumed they could grow this back to 1.20m and this might now be slightly ambitious.

TV KPIs slightly weaker than expected in Q4

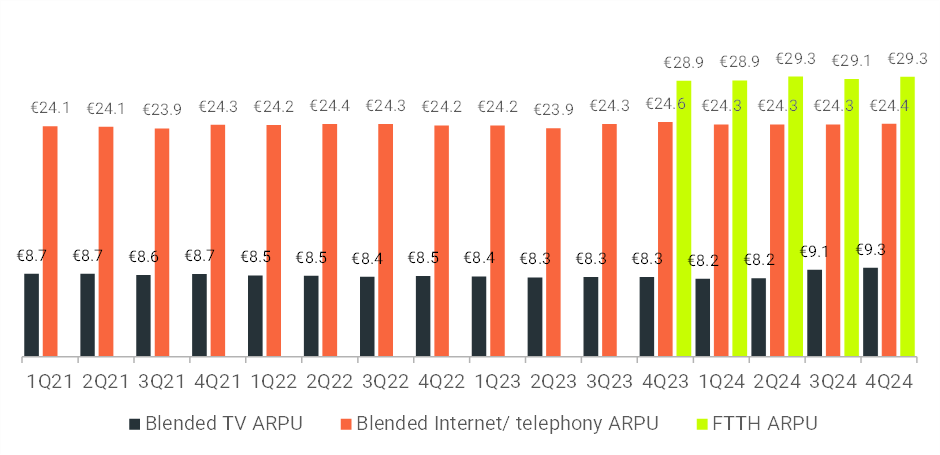

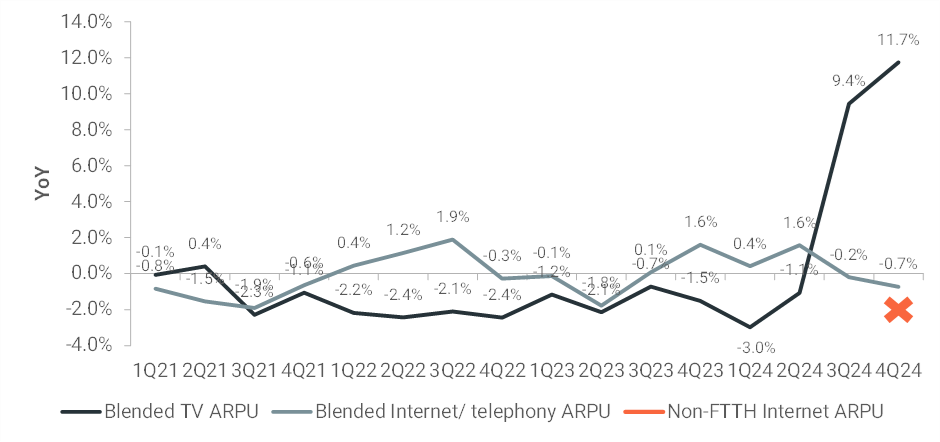

Reported ARPUs on the TV base though have improved as the lower ARPU bulk TV customers are removed from the base. In Q4, the TV ARPU increase was c.12% YoY, but this should all flatten out from Q3 25 when we start to lap consistent periods that remove the impact of the bulk migration.

Looking at broadband ARPU though, we can see that the trend rates have slipped back to -0.7% YoY, and this is despite the upsell to FTTH across some of their base. if we strip out the impact of the upsell to FTTH, we can calculate that the ARPU on the HFC platform is currently declining at a slightly steeper rate of -1.9% YoY. This is slightly worse than we had been expecting as we had been hoping to see ARPU trends marginally improve as the impact of introductory promotional pricing for new net adds should be influencing a smaller % of their overall base.

We believe that this slightly weaker ARPU trend is being driven by a) the desire to maximise net adds, so presumably some introductory promotions on door-to-door sales are now being slightly more aggressive, and b) the German market does remain competitive with DT in particular trying to push more homes into family plans with converged wireline using aggressive mobile pricing with unlimited data SIMs.

Looking forward though, the company has put through a c.€2/ month increase on c.150k Internet customers in February 2025 (c.20% of their base) and this should therefore help support ARPU by c.1% in Q1 (and c.1% in Q2). Therefore, we would hope to see some modest improvement in coming quarters.

Reported ARPUs and growth rates

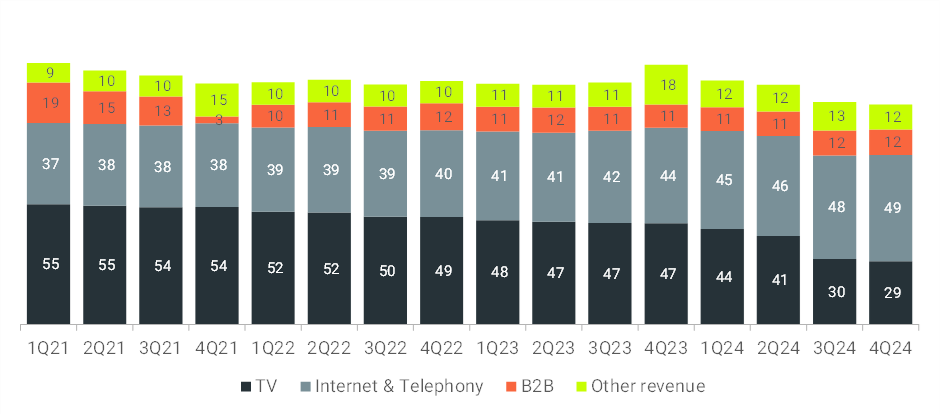

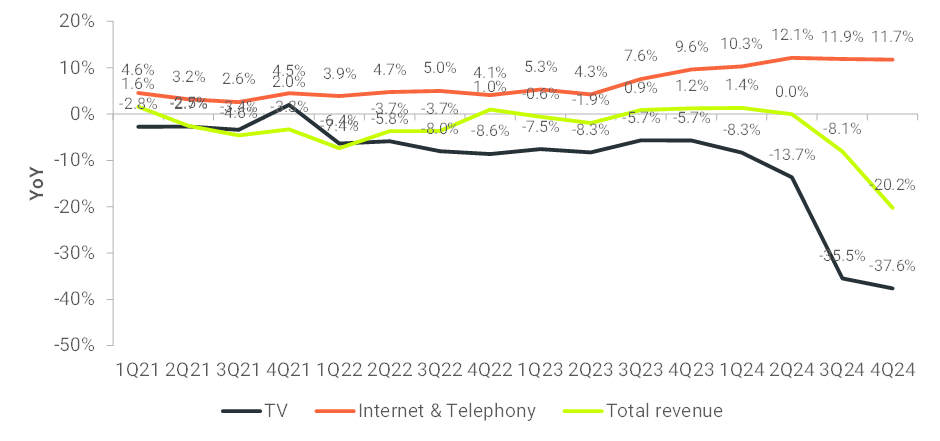

Looking at overall revenue trends, the “elephant in the room” at the moment is the decline in the TV revenues from the bulk migration process, but this should start to lap out from Q3 25 when looking at the YoY comparables.

Furthermore, in Q4 24 there were lower one-time revenues from construction work (which has limited EBITDA impact), but this does impact the headline rate of overall revenue growth.

Revenue trends – impacted by TV migration and low-margin construction revenues

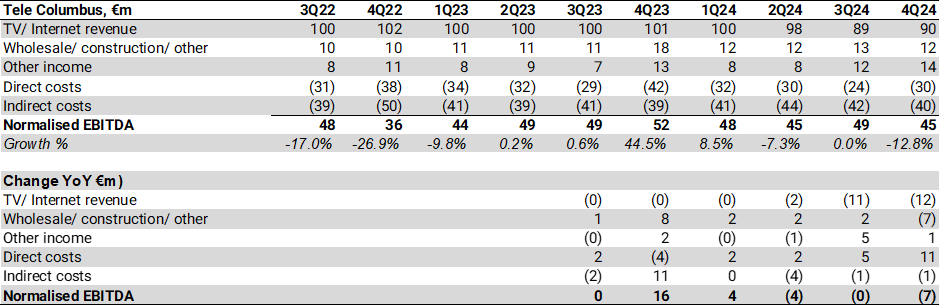

Looking at EBITDA, in Q4 this was down 13% YoY in Q4, which was 4pp better than we had in our model. Dissecting the key drivers of the YoY change in EBITDA, ie a decline of €7m YoY, the main driver comes from the decline in the high-margin TV revenues, but the better than expected performance came from the higher reduction in in direct costs (being higher than the decline in low margin construction/ other revenues).

Key drivers of EBITDA change

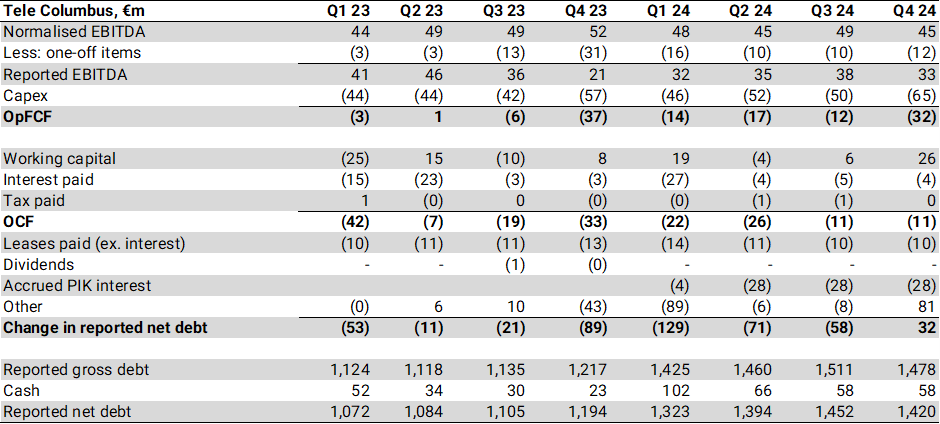

If we then assess their cashflow performance in Q4 24, we would highlight a few key points:

- Overall OCF of -€11m was better than our expectation of -€18m.

- This was driven by working capital inflow of €26m being materially better than our expectation of a €6m outflow. We understand that this is a structural and sustainable benefit from better inventory and receivable management and doesn’t imply we should see this reverse by year-end 2025. We would therefore expect working capital movements to be stable in 2025.

- However, offsetting this cash capex of €65m in Q4 was higher than the €45m that we had been forecasting.

FCF summary – better than expected OCF in Q4

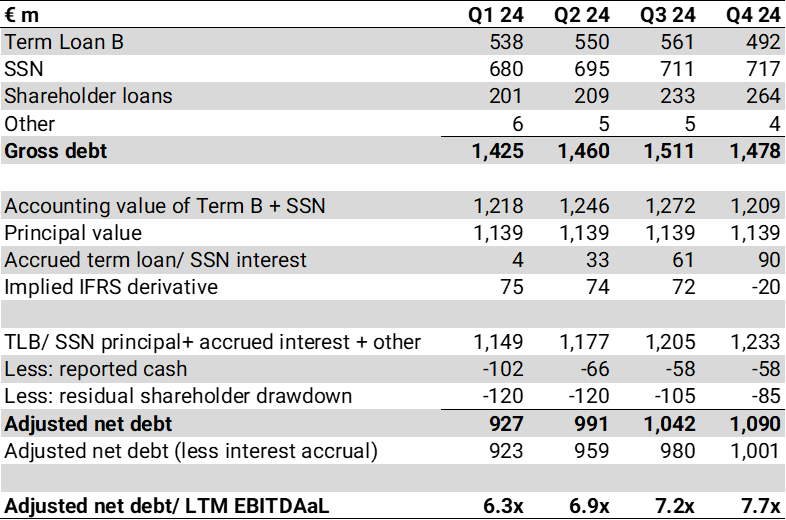

If we then look at the impact to the reported net debt, we believe some further adjustments need to be made to the accounts as presented, which we aim to do below:

- One needs to be aware of the accrued PIK interest including in the reported net debt figure, which we estimate has grown to €90m by Q4 24 on the Term Loan B and the SSN.

- The face value of the debt also includes an IFRS related derivative. We know that in Q2 24 this was €74m, but we don’t have full visibility on the exact movements since then. However based on the decline in the face value of the Term Loan B, we estimate that this has now swung to -€20m at end Q4 24. We don’t yet have full visibility on this, and we will be reverting on this point when we do a full model update.

- The shareholder loans are still included in gross debt, but these will be converted into equity in due course.

- At end Q4 there was still a residual €85m of the €300m Kublai/ MSIP commitment to be drawn down. This was then fully drawn down in Q1 25.

Adjusting for these items, we believe a real “adjusted” net debt figure is closer to €1.09bn (or €1.00bn excluding the accrued PIK interest).

Based off the €1.09bn net debt figure, we calculate a LTM net debt/ EBITDAaL of 7.7x.

Breakdown of TeleColumbus debt position

Guidance

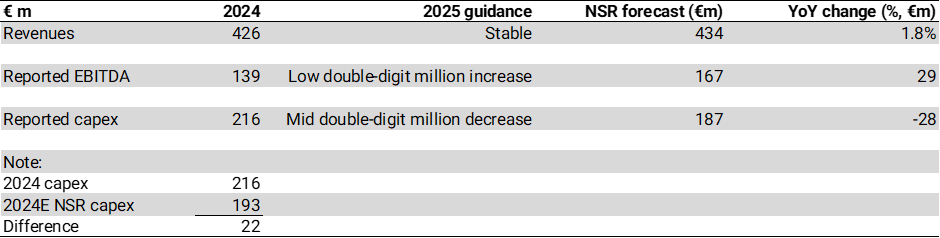

Finally, TeleColumbus has provided new guidance for 2025, which we summarise below and which should lead to better FCF generation in 2025 of c.€20m vs. expectations, which provides some incremental support to the liquidity situation.

Key guidance parameters for 2025

Key points:

- “Stable” revenue growth. Our current forecast is for 1.8% growth, so broadly in line with their guidance, as Internet growth will offset continued TV revenue declines in H1 25.

- “Reported” EBITDA to be up by “low double-digit million” of Euros. We are slightly disappointed to see the guidance done on a reported basis, as this is at the mercy of the non-recurring items, which are expected to be down in 2025 and therefore support the EBITDA growth. However, we don’t know the split between the expected decline in one-off items and the underlying EBITDA growth, which is more relevant for ascertaining longer-term value. We understand that the company should give more information on this in a month’s time at the Q1 results.

- However, our model has a €29m increase in reported EBITDA – which maybe is slightly more optimistic than their qualitative guidance. This breaks down as a €5m increase in normalised EBITDA and a €24m decrease in one-time items. We await more details on this point, but we would hope to see the company achieve modest underlying EBITDA growth, especially if they hope for stable revenue growth.

- Capex is likely to be down by c.€50m (“mid double-digit million decrease), and this would be better than the €28m decline we have in our model. However, offsetting this 2024 capex was c.€22m higher than expected, so over the period 2024 and 2025, cumulative capex will be broadly in line with our expectations. However, in 2024 this higher capex was offset by better working capital management, and therefore in 2025, it does imply that underlying cashflow should be better than our current expectations (albeit we await more finely tuned EBITDA guidance).

- Medium-term liquidity though will be driven by potential corporate activity around the NetCo/ ServCo separation or additional funding avenues – and please see our recent deep-dive note for all the details on their options here.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.