DT Q2 25 – Solid financials, but broadband market slowing

DT’s Q2 financial results were all in line with expectations and all guidance has been reiterated. However, now that all of the German operators have reported we can see that there are increasing signs of the broadband market in Germany slowing faster in Q2, albeit this is being offset by more encouraging pricing trends.

Softbank has also announced a further $3.0bn sell down of TMUS shares into the market in August.

Overall, we think the initial market reaction to DT’s results appears overly negative and we assess this further in this note.

Overview

DT’s Q2 financial results were broadly in line with expectations and all of the current financial guidance (which now includes the recent minor upgrade to the TMUS outlook after their Q2 results) has been reiterated.

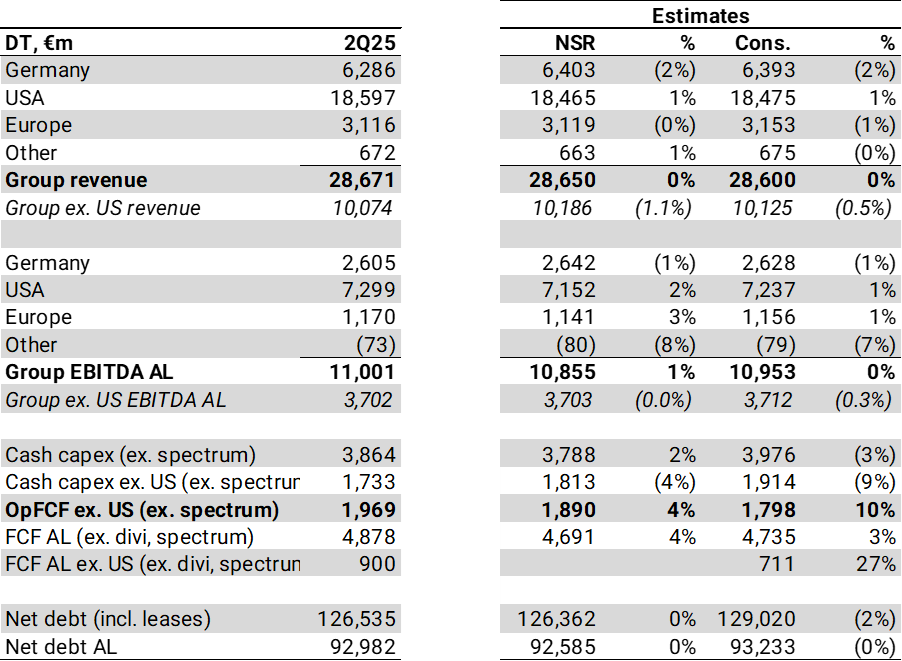

Summary of results vs. expectations

Looking at the German performance more specifically, service revenues were broadly in line with expectations, albeit broadband net adds of -20k was weaker than the -7k seen in Q1, and vs. consensus of -5k.

Branded postpaid net adds of 185k (which is always a volatile number quarter-to-quarter) was a decline from the +274k seen in Q1 and the company is calling out signs that the B2B mobile market has become a bit more competitive due to actions from Vodafone and O2, with a single customer loss of 80k in the quarter.

DT Germany vs expectations

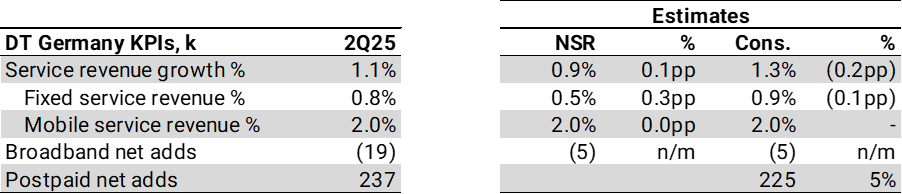

Total service revenue growth in Germany of +1.1% YoY slowed modestly from +1.4% YoY in Q1 predominantly driven by the slowdown in MSR from +3.1% YoY to +2.0% YoY – albeit the company did call out the Q1 MSR performance as particularly strong, driven by phasing.

Fixed service revenues continue to be dragged down by the slowdown in IT revenues linked to the hiatus in the German Government transition. Now that this is behind us, we would expect to see this recover as we go into H2, especially as the comparables will become a little bit easer.

DT Germany trends

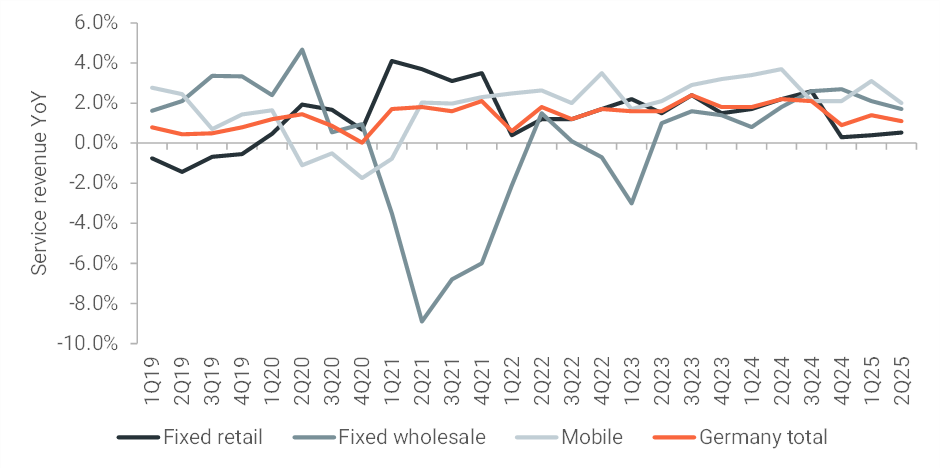

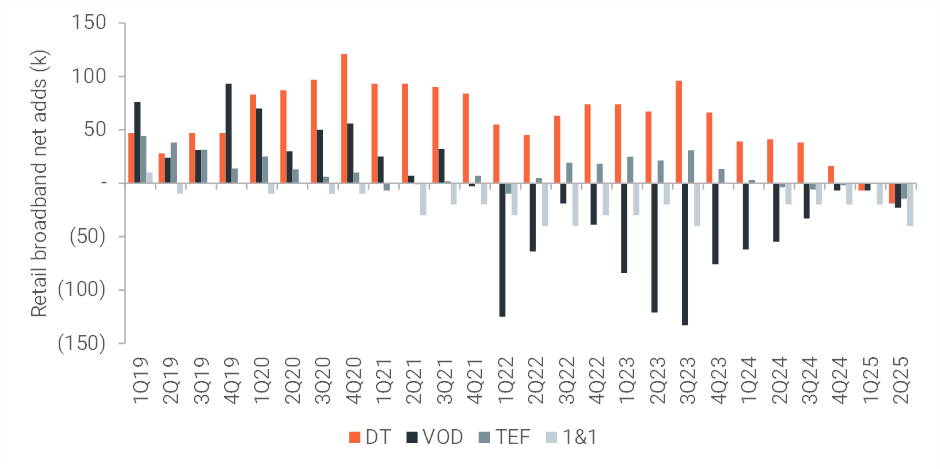

Assessing this a bit further, we believe a lot of market focus could be on the -20k broadband adds figure reported by DT as we do see that the overall performance of the main 4 players (ie DT + Vodafone + Telefonica + 1&1) has slowed in Q2 to a low of -97k broadband customer losses.

This implies that overall market growth seems to have slowed to close to zero (vs. our prior expectation of c.+200k annual market growth) and in particular, it would now appear as if the altnets are taking more share outside of the VDSL areas, ie in the rural areas, and this is affecting all of the main players.

Germany broadband market net adds has slowed

DT Germany broadband losses worsen to -20k

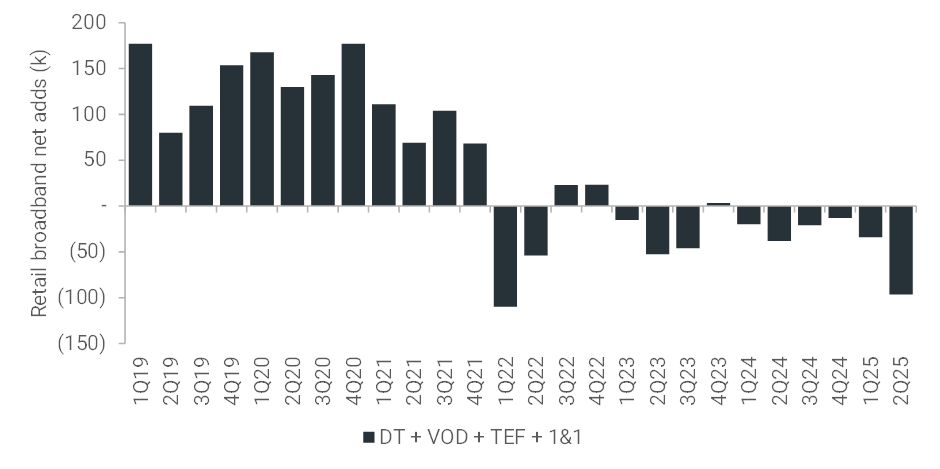

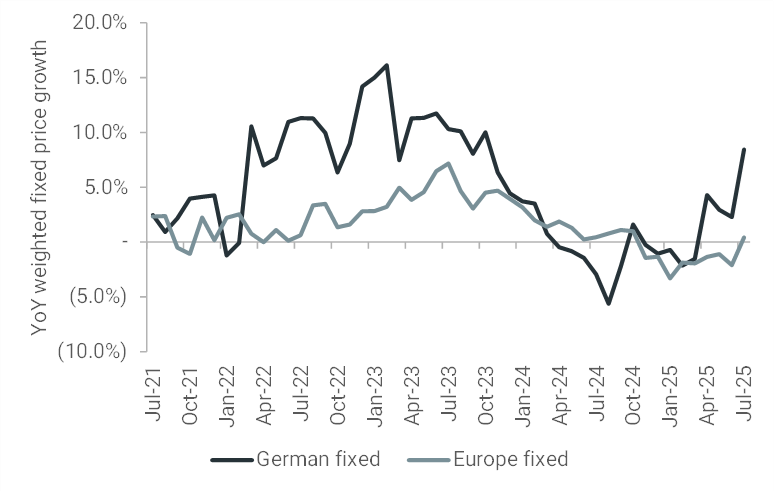

While this clearly doesn’t read well as a headline, we do though see offsetting trends with the larger players becoming more disciplined on pricing.

Based on our Tariff Tracker analysis, we have seen a recent stronger recovery in German market broadband pricing trends, and specifically DT has recently reduced its promotional period from 6 months to 3 months. We have also seen Vodafone reduce some of its commissions in its indirect channels.

Given the market seems to have been less promotional on pricing (leading to lower net adds) and most of the share losses have been outside of the VDSL areas, we believe that this could suggest Q2 KPI trends for TeleColumbus should be reasonable.

German broadband market pricing improving

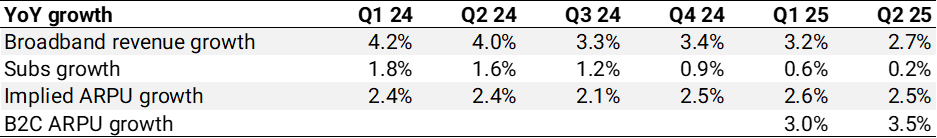

This pricing improvement can also be seen in DT’s reported broadband ARPU trends, which have remained stable in Q2, but the B2C broadband ARPU growth has improved to +3.5% YoY (implying an offsetting slowdown in the B2B ARPU trends).

Broadband ARPU trends more consistent

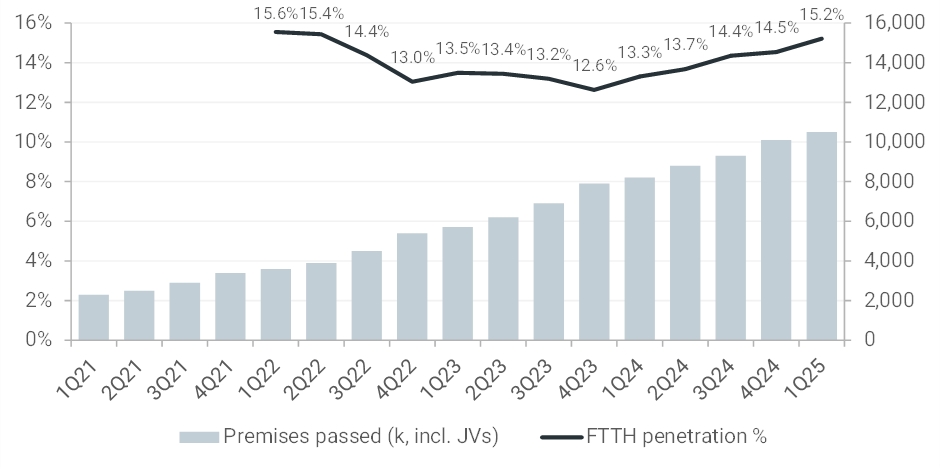

There will also be modest support to ARPU as we see more customers gradually migrate to FTTH, albeit we must flag that in Germany, this process is going to take much longer than the rest of Europe. While this FTTH customer transition is taking longer, this isn’t necessarily a bad thing as we believe there is a greater chance in Germany of reduced fibre overbuild leading to a longer-term market structure that should be more rational than other markets where we see more overbuild risk which could lead to greater pricing uncertainty.

DT Germany FTTH penetration creeping higher

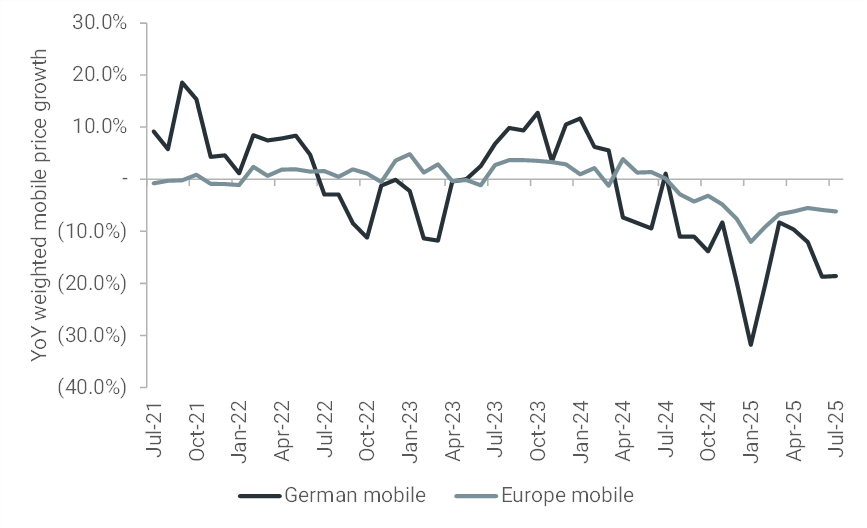

While the pricing environment in fixed line is improving, the trends in mobile pricing are still not as encouraging as we would like to see.

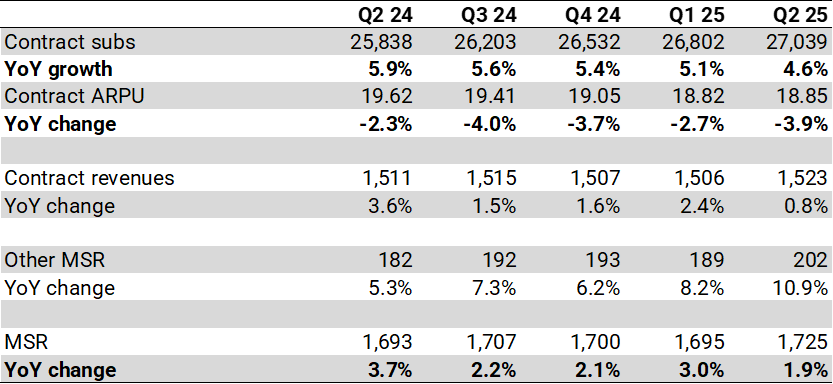

DT’s contract ARPU growth declined to -3.9% YoY in Q2 25 – a trend that has been weak for a few quarters now as DT (and the other carriers) continue to push second-SIMs diluting the overall ARPU. For the time being, there is enough growth in the overall subscriber market to support this, but we question how much further this growth in SIM cards can continue.

Breakdown of DT’s MSR – showing contract ARPU decline offset by 2nd SIM growth

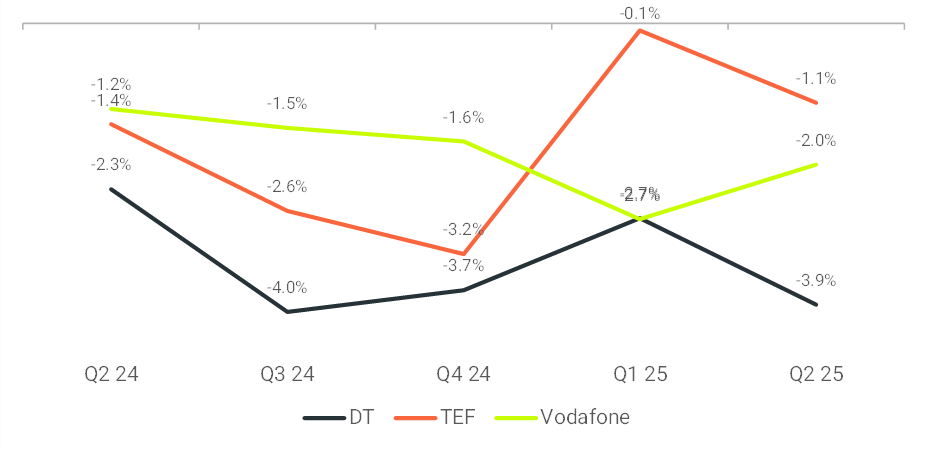

The issue of mobile contract ARPU decline is not just isolated to DT within the market, albeit DT’s ARPU trends are definitely weaker than Vodafone and Telefonica.

Contract ARPU YoY declines for all the main players

On our Tariff Tracker data though we do believe the mobile pricing trends in the wider market continue to be competitive – and after we saw a brief recovery in pricing in March and April, weaker trends have come back in June and July.

German mobile pricing trends have slipped back in recent months

More cautious stance already in model: In our model, we do already assume that German MSR is likely to slow further in 2026 and 2027 to +1.3% and +0.6% respectively, ie below DT’s guidance 2-2.5%, and although we are aligned with DT’s financial guidance for 2025 – we are at €15.5bn EBITDA in 2026, ie below their €16.0bn guidance.

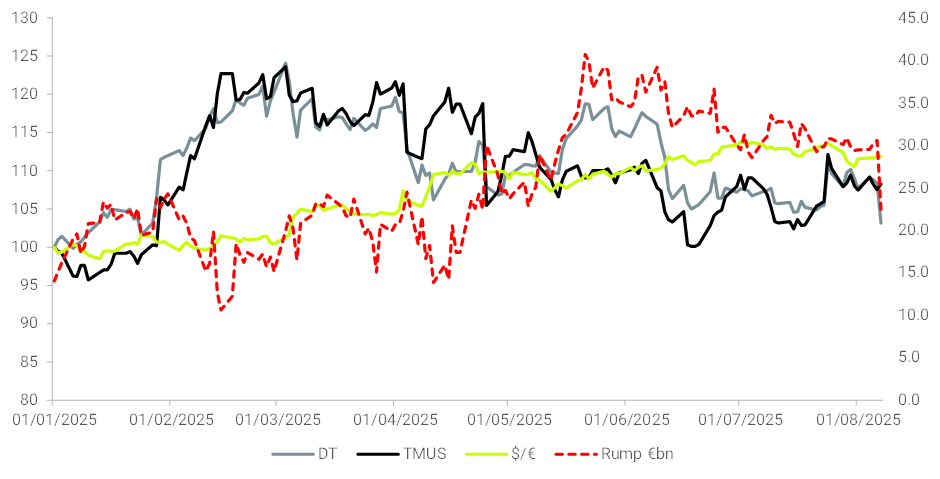

Valuation and TMUS share sale

Until this morning DT’s shares (in €) and TMUS shares (ins US$) have broadly performed in line with each other YTD, despite some volatility along the way. However, given the weakening US$ since the start of the year, it implied that until this morning the ex-US value had increased to c.€30bn from €14bn at the start of the year. This moved up sharply at the time of the TMUS Q1 results, and it had broadly held this level since then. However, this move this morning – with the shares down 5% at the time of writing – would imply a material decline in the ex-US value back to €22bn, ie there has been an implied 27% decline in the non-US business and this seems like a severe over-reaction on the back of today’s results.

Today’s share price move seems like an over-reaction – 27% decline in ex-US business

Softbank/ TMUS share sale: Since the shares started trading we have also seen that Softbank Group has reported their own Q1 results – and in their results, they have just reported that they have sold 13m TMUS shares into the market during the first 5 trading days in August and have realised $3bn of proceeds from these sales. This follows the 21.5m share sale for $4.8bn that Softbank did back in June.

While we are slightly surprised that Softbank now seem to be drip-feeding TMUS shares into the market, rather than through a structured placing, we do take comfort from the fact that during this period the TMUS share price has been flat – and in line with the overall US market performance.

This now leaves Softbank with 50.9m shares, ie a further $12bn stake or 4.4% of TMUS and we would expect that they would look to sell down these shares to fund their own AI ambitions over the coming quarters. We believe that there is an overhang of some magnitude being factored into the TMUS shares already – and therefore as this clears over the coming 6-12 months, we would see a case for technical upside for TMUS, which should then act as a medium-term support for DT’s share price.

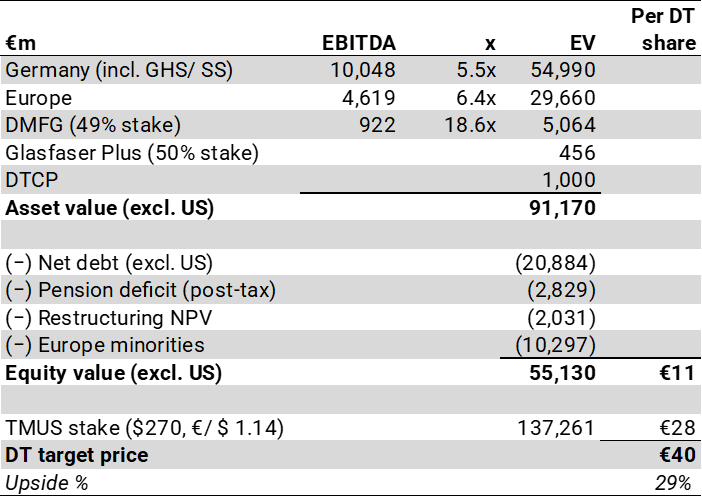

Our base case value is for the ex-US value to be €55bn (putting Germany on 5.5x EBITDAaL) and this is where we continue to see upside for DT – but even at the current market price for TMUS ($239/ share), it would still imply a fair value for DT of €37/ share. While any imminent catalyst for DT to suddenly outperform is not clear, we do think the ongoing dividend growth and a recovery in the TMUS share price based on fundamentals and as the Softbank overhang clears should be a key support for longer-term DT share price appreciation.

Sum-of-parts of €40/ share

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, Birchin Court, 20 Birchin Lane, London, EC3V 9DU. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.