SK Telecom – Q3 25 Quick Take: Dividend cut

What’s new: Numbers were in-line with expectations, but shares fell slightly today due to the absence of dividends this quarter, implying a dividend cut for the year. Nevertheless, with the overhang on the data breach fine removed and recovery now in progress, we think SKT’s valuation is compelling for investors who can look past this year. We therefore stay Buyers with a KRW 78k price target.

Key takeaway:

- 3Q25 performance was as expected as SKT had previously announced a 50% discount on August’s bills as part of its Customer Appreciation Package. Both revenue and EBITDA were in-line with consensus. The company has also paid off the one-time fine (KRW134.8bn) to PIPC. The key source of disappointment however is the absence of dividends in Q3 given this quarter’s net loss and the lack of dividend visibility from management on the call. We had assumed dividends to stay flat for the year while consensus anticipated a 1% drop.

- Nevertheless, we see signs of recovery. SK broadband improved to 3.4% YoY from 2.5% on B2B strength. AIDC accelerated to 54% YoY through the Pangyo DC acquisition and together with AIDC now forms 5% of revenue, up from 3% previously. As a reminder, SKT’s medium-term goal is to double its capacity from 137MW today to at least 300MW by 2030, aided by the Ulsan AI DC which is set to operate from 2027. Altogether, SKT expects AIDC revenue to contribute KRW 1tn in sales by 2030.

- Based on the Group’s KRW17tn revenue guidance for 2025, it implies another decline in Q4 albeit at a slower pace (-6% YoY) but consensus is more optimistic (-3% YoY).

- Having lost 1m subscribers last quarter, the resumption of mobile net additions (+130k) is encouraging. Management commentary suggests they have no intention on taking back subscriber share, which bodes well for the overall sector.

- To support its customer base, the company had introduced an e-SIM product called “Air” in October. Targeted at the younger populace, it is an online-only registration with same-day SIM delivery. The plan starts from KRW 27k for 7GB to KRW58k for unlimited data and is likely to have limited impact on ARPU.

- SKT’s domestic Personal AI Agent, A. surpassed the 10m subscriber mark. This comes 2 years after launch and the pathway to monetisation, either through an add-on or bundled service is expected to commence in 1H26. Within the B2C AI space, we remain somewhat sceptical on SKT’s ability to drive good returns from its AI investments. Where we do see promise is its 2B use cases as SKT expects some revenue to start flowing through in Q4.

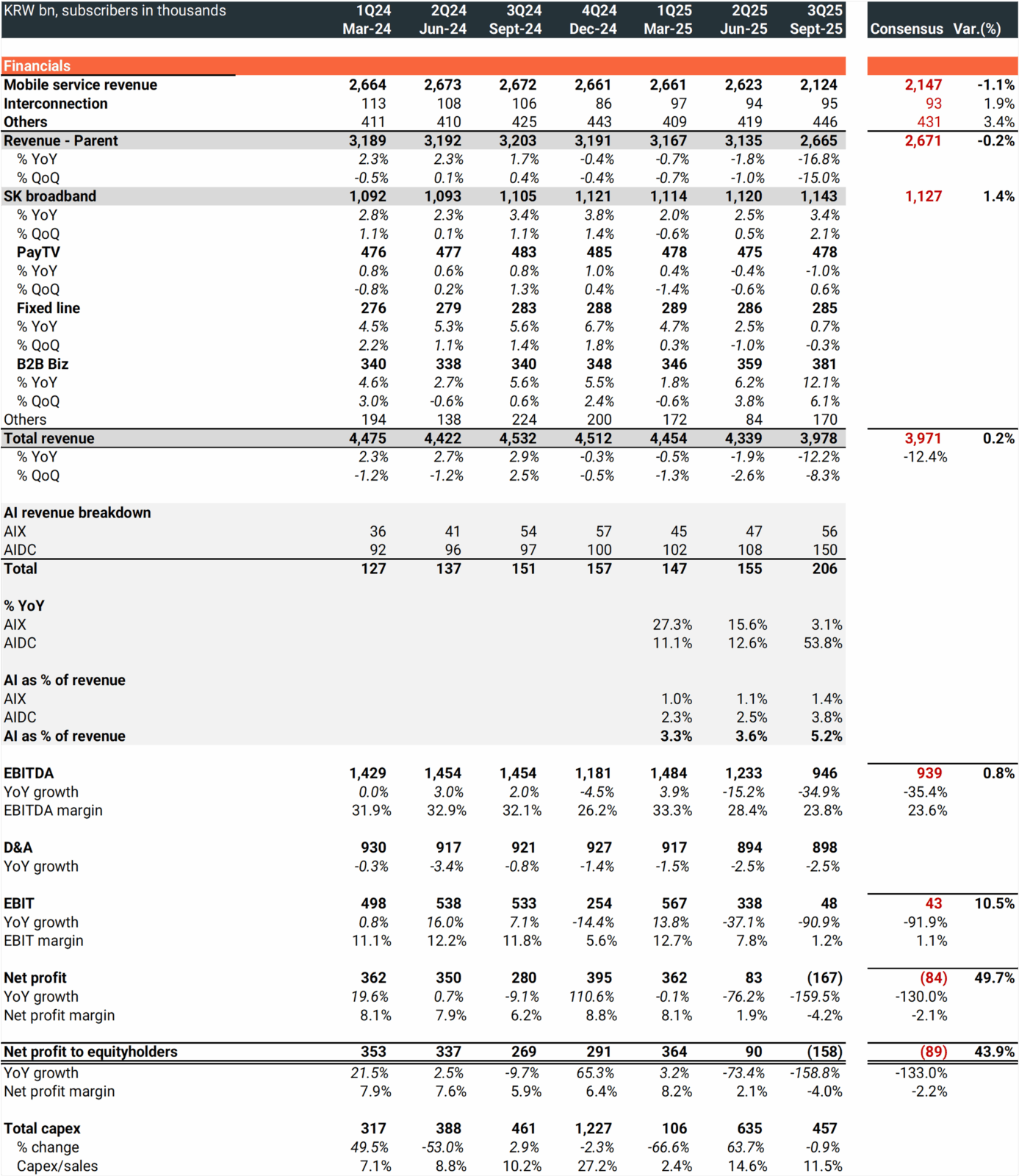

Key Financials

Source: Company data, Visible Alpha

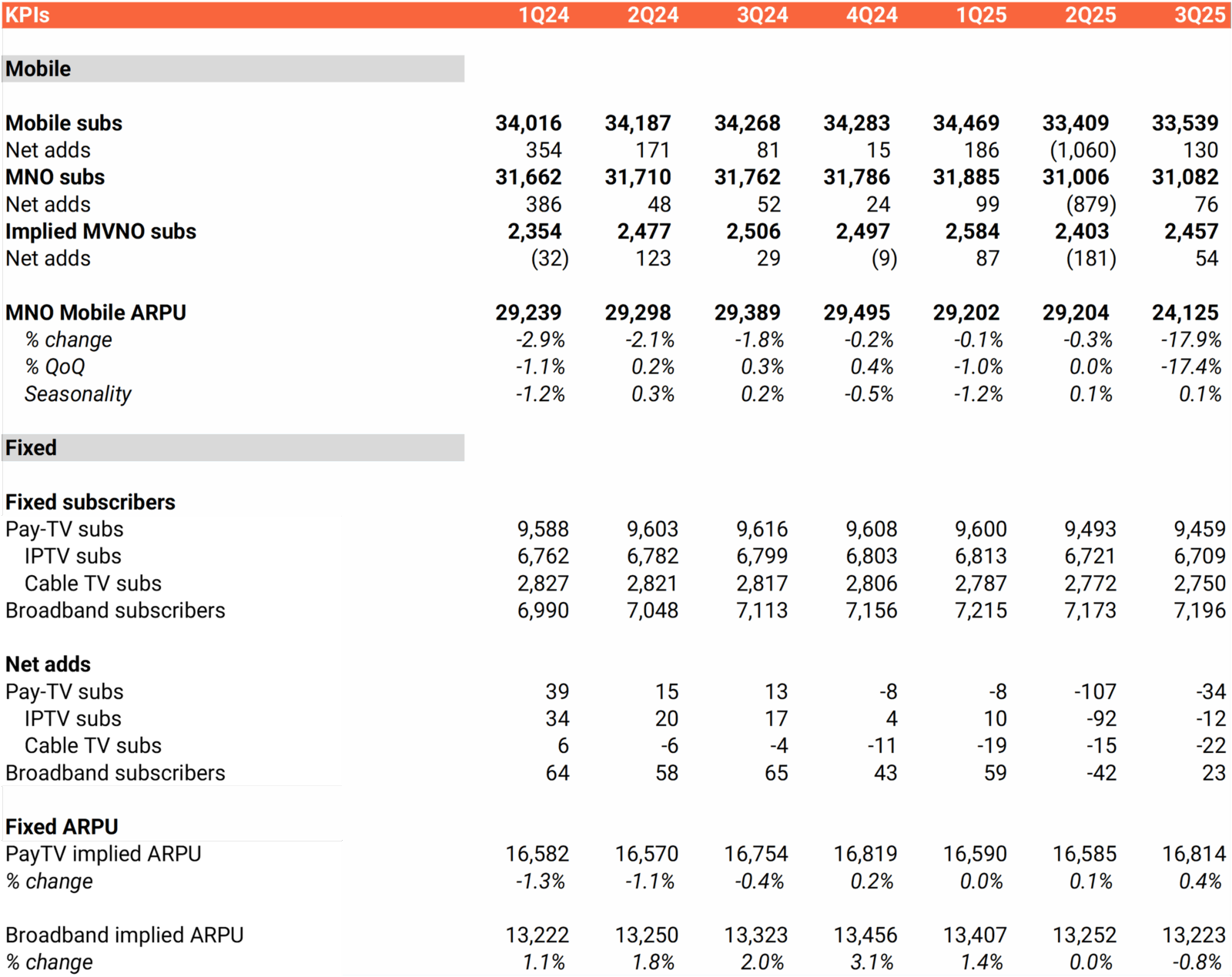

Key Performance Indicators

Source: Company data, New Street Research analysis

Conclusion: 3Q performance was as expected and the resumption of mobile net additions and improvement in SKB performance were encouraging. However, the lack of a quarterly dividend is negative. At current price levels however, valuation is compelling, and we see it as an opportunity to accumulate. We stay Buyers of SKT with a KRW 78k price target.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, Birchin Court, 20 Birchin Lane, London, EC3V 9DU. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.