MercadoLibre (Buy) - Target lift to $1,600; Model update post Q3s

We ran through in detail our thoughts on MercadoLibre Q3s after the print. We are now updating estimates and revising our target from $1,450 to $1,600/share.

See MercadoLibre Q3s – Strong beat; Credit getting more focus for details on results.

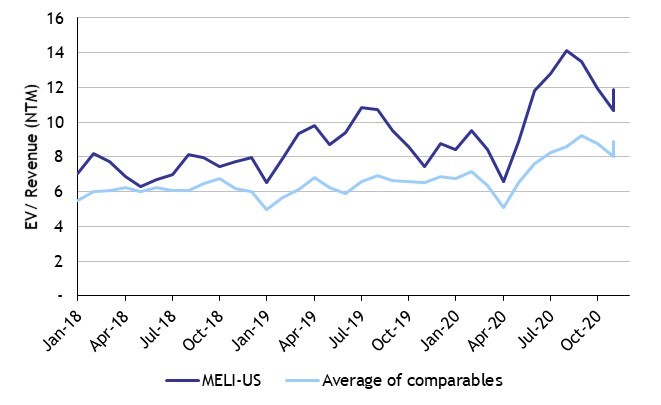

Note that despite the bounce yesterday, MELI hasn't broadened its premium versus Payment and E-Commerce peers.

NTM EV/Revenue vs Peers (E-Commerce and Payment blend)*

* Factset. Note, we use our numbers on MELI since initiation but Factset prior to that. This partly explains the step down in the multiple in Oct-20 (we are well ahead of sell-side consensus)

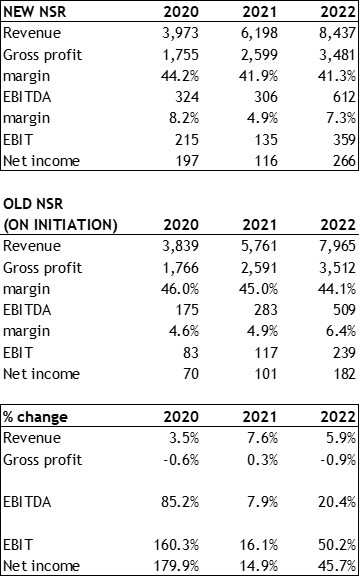

As a reminder revenue trends came in well ahead of our and consensus expectations and we have pushed up estimates. See changes to estimates below.

In moving up numbers, we would highlight the following:

- Management appears to be feeling better about the underlying Brazil E-Commerce asset such that it feels it can compete more competitively in Q4 promotions. This looks to be a combination of:

- Better logistics (less reliance on Correios)

- Greater 1P optionality (an important tool in the kit for promotions). The CFO wouldn’t disclose the exposure to 1P but it’s likely to be low to mid-single digit of GMV

- More competitive pricing on key verticals such as Electronics. As well suggestive of strong GMV for Q4, it’s reassuring for LT value creation in the business.

- As well as E-Commerce, Fintech is performing well. We are enthused about efforts to monetise m-wallets (particularly in Brazil) and the development of Credit. However, in the near-term the bulk of the revenue beat is coming from a combination of:

- Higher factoring linked to stronger GMV (on-platform factoring is booked in Fintech even though MDRs are not), and

- A return to better TPV on the Acquirer business, with MPOS in particular called out this quarter as having returned to pre-Covid levels. Upside for MPOS could come from moving up the value chain on merchants, as evidenced by the launch of Point Smart which offers a number of incremental services for merchants (better battery, free 4G data plan, greater payment options (chipped cards, as well as QR), printing.

- PIX will launch in Brazil in Q4 (November 16th). We don’t expect a revolution overnight but it’s fair to see this as the start of a positive force for both,

- E-Commerce more broadly, and

- App engagement as the ~45-50m unbanked in Brazil are able to make payments on-line.

- The Andean region received more focus on the call than in the past and will start to build toward a more meaningful contribution to group GMV going forward.

- We are mindful of being too positive on profitability developments given the business is being run for growth. With that said, and after a beat at EBITDA, on the call CFO Pedro Arnt suggested that MELI had been able to find good growth at a higher level of profitability. This would be an additional positive, although ultimately the market’s focus will likely remain on the top line.

We show our changes to estimates below, noting that we are still some way ahead of formal consensus.

Changes to estimates, USD millions

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.