PagSeguro (Buy) Q4s - Quick Take: Revenue beat; Strong momentum early 2021, Hubs bring optionality

Q4 results highlights

- Revenue growth (ex interchange) in Q4 increased to 28% y/y, up from 15% the prior quarter

- The driver was both underlying transaction revenue as well as a return to (modest) growth of factoring revenue, which is dependent on credit use and in turn on macro trends

- The mix of credit to debit was broadly stable on Q3 (51/49) and still down then on the more favourable 60/40 (credit/debit) mix of pre-Covid; with that said, Q4 tends to see seasonally lower debit spend (13th salary) and so maintaining this level was a positive underlying move

- Acquirer TPV accelerated to 56% y/y from 44% in Q3 (ex Coronavoucher top ups)

- Take-rates drifted down slightly and will benefit also from a return to a healthier credit mix

- Active merchant adds was 765k, of which 303k was underlying (ex-Moip acquisition), representing only a slight slowdown on the very strong Q3 momentum

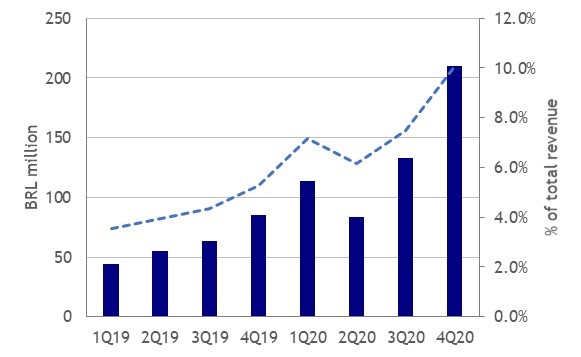

- Pagbank revenue came in at R$210m, up 58% sequentially and reaching over 10% of group revenue

- We are looking for Pagbank revenue of almost R$1.0 billion in 2021. This sort of pacing (+R$80m/quarter) would see them blow through our revenue estimate.

- The mix of card revenue (interchange) to total revenue fell in 2020; in part this is a product of the expanding loan book but also due to the lower level of card usage (given lockdowns during the pandemic). This should naturally accelerate with the economy opening up.

Pagbank revenue and % of total revenue

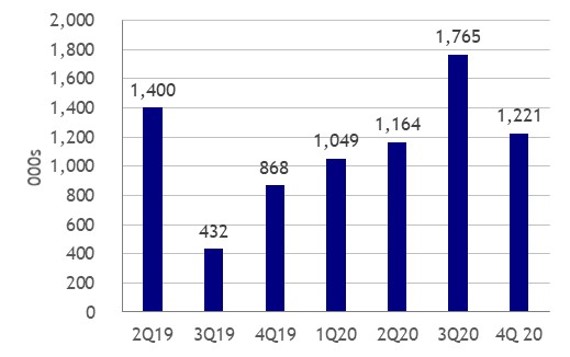

- Pagbank active subs reached 7.9m, adding 1.2m in the quarter, not quite keeping pace with the very strong Q3 (although this wasn’t expected)

- The consumer contribution continues to increase, representing 50% of net adds in Q4 and taking the total to 34% of total Pagbank active customers.

- This is quite significant as PAGS is seen as being well positioned to sell banking services to existing merchants where it has relationships, but without such an obvious right to win where it is targeting new customers.

Net Pagbank active user additions (launch early 2019)

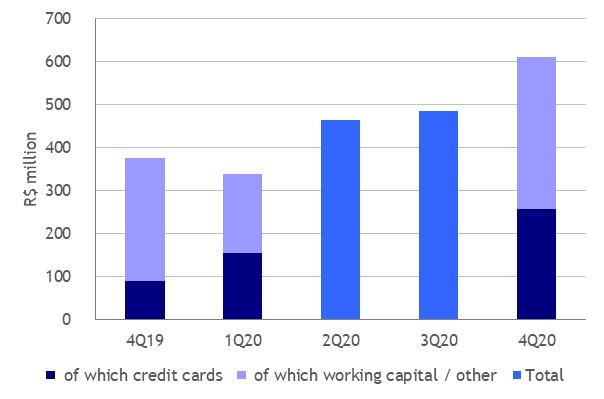

- The Pagbank credit book increased to R$612m, up 26% sequentially; we had assumed a YE book of R$500m. Management cautioned that this was still not being pushed aggressively yet as they are waiting for more clarity on vaccines and economic recovery

- Note the credit book is now fully funded by 3rd parties (CDBs)

Pagbank loan book development

- Capex came in slightly ahead, although this is largely a function of the very strong merchant adds (and capitalised POS equipment, as well as ongoing R&D investment)

- Net cash closed the year at R$8 billion – it’s notable this is the first time in which management has shown this including the accounts receivables (R$16 billion). While we included this in our valuation, it seems not everyone does, in part as management has not focused quite so clearly on this as a key metric (unlike Stone in the past).

Outlook – strong start, guidance looks to be conservative

- The steer on Q1 2021 trading was positive, with TPV volumes in January and February growing >50%. Note, Jan and Feb were not impacted by Covid and from late March the comps will get much easier (Q2 2020 saw TPV of just 11% y/y).

- Revenue growth in the same months is running at 30% y/y. Given this matches Q4 revenue growth, but with a slightly slowdown in TPV, management suggested this was indicative of better yields

- For 2021 expected acquirer TPV is >40%.

- Given Q1 momentum and a very weak Q2 2020, we see this as cautious

- We suspect management is keen to leave the options of upgrades to guidance open through the year, while only a material turn for the worse Covid wise would threaten the outlook

- Capex will run at another ~R$2 billion level in 2021

- We are at R$1.7 billion but suspect ahead of consensus which hasn’t really factored the strong subs growth into capitalised equipment costs (in part due to a 2019 accounting change perhaps)

- In 2022, expect capex to revert to 2019 levels (low to mid-teens)

- We have this broadly in estimates

- Expect D&A to be R$800-R$1 billion

- In a similar vein to capex, the market has been underestimating the depreciation of POS equipment

- Pagbank guidance

- Reiterated on track to hit 30% of revs from Pagbank in 2024 (during). No steer on 2021 and will depend quite heavily on the extent of the vaccines and macro

- Reiterated Pagbank will be net income positive from 2022

- Pagbank margins in the long run should be similar or higher than underlying (acquirer) margins

- There is no net income guide for 2021 other than to say it will be up on 2020

- This shouldn’t be too hard given the pandemic (and the credit/debit TPV mix) took 6.2pp off net margins (reported at 21.0% in 2020). Any easing in trends will support margins

- The hubs initiatives will partly offset with losses, but they should only run for 4-5 quarters (and turn positive around Q2 2022 therefore)

- We have net income margins up ~2.5pp in 2021. Given strong top line growth this correlates to ~50% growth in absolute terms

New initiatives – Hubs; could pave the way for further credit

- PagSeguro has been quietly piloting a Hubs strategy in 2020 (which contributed negligible revenue). This is something akin to the Stone model, although will be filling in a niche between Stone’s larger targeted SMB target and PAGS’ existing micro merchants

- This is set to be expanded in 2021, targeting 250-300 hubs and representing 6-11% of TPV

- At the mid-point of the year, assuming ~45% TPV growth is possible, this suggests a total TPV for hubs of R$20 billion, or R$72 million per hub

- The company believes that typically these SMBs will be underserved from an acquirer or banking perspective – but it sounds like they typically have existing relationships. As a result, PAGS believes it will be partly gaining share, rather than bringing services for the first time (as per a lot of the long tail micro merchants)

- Banking services may be offered by PAGS, but not initially it seems given the nascent nature of the service. However, this is exactly the sort of market where we are seeing strong credit growth in Brazil and potentially see this as another leg up to the credit story in Brazil

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.