Softbank Corp Q4: Strong Q4; 2021 guidance ahead at revenues, and in line on profit

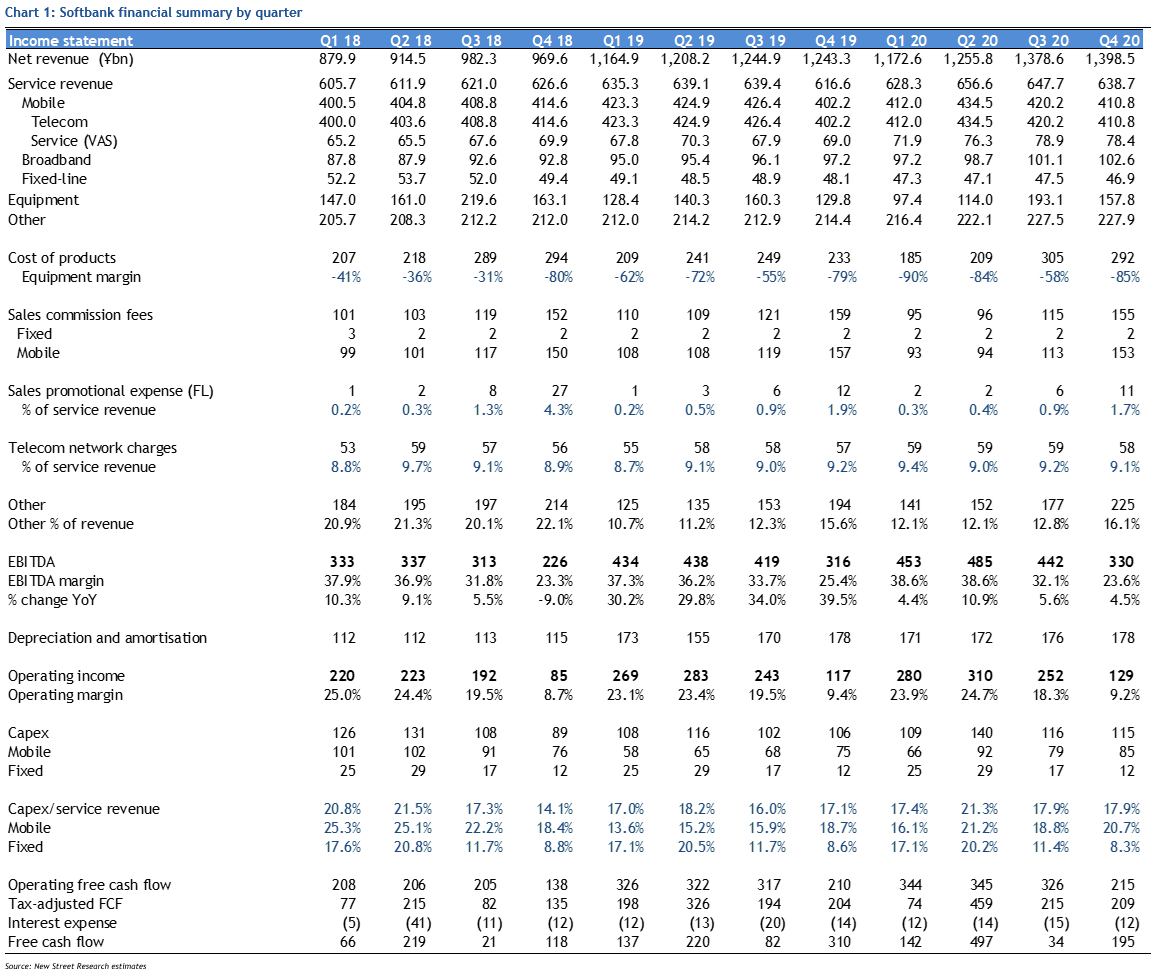

Softbank Corp has reported a strong set of Q4 figures, with numbers beating guidance which itself was raised at Q3. Guidance for 2021 is well above forecasts at the top line, and in line at EBIT and net profit; which is positive given the history of beating guidance, with the only negative in guidance a flat dividend forecast at ¥86 whereas we expected an increase to ¥88. Enterprise revenues were strong again at +9.5% YoY (Q4 10.4%), driven by IoT and other services, and Enterprise EBIT more than doubled on a YoY basis. We think this is a key area where the upside is substantial in Japan. But most importantly, MSR inflected from -1.5% to +2.1% YoY, with no sign yet of either increased Rakuten customer adds or price cutting having any effect. The reason: 5G which also drove strong equipment sales (+22%). With strong equipment sales, margins were down 180bp on a YoY basis, and EBITDA growth slowed to 4.5% from 5.6%, but EBITDA was still 7% ahead of consensus. Operational guidance for 2021 is generally strong: revenue of ¥5.5trn compares to our forecast (and consensus) of ¥5.2trn, and implies top line growth of nearly 6%. EBIT of ¥975bn compares to our forecast of ¥955bn (consensus ¥990bn) and Net profit of ¥500bn compares to our ¥488bn (consensus ¥496bn). The stock has rallied over the last 6 months but remains below the IPO price yet operationally trends continue to be robust. SoftBank remains our top pick among Japanese telcos.

Key takeaways:

- Q4 figures were good across the board. ZHD had previously reported, but the new figures released today were strong on the top line in all areas: Mobile, Enterprise and Distribution. Margins deteriorated but this is probably a function of very strong equipment revenues, and in any event EBITDA was still 7% above consensus.

- Enterprise revenues were very strong: Enterprise revenues were +9.5% (Q4: +10.4%), and Enterprise EBIT more than doubled YoY (+124%). The company has previously said that Enterprise is entering a period of “explosive” growth. We think demand drivers for enterprise services such as cloud and IoT are strong in Japan, and this is a core reason for our more bullish view of the Japanese telcos (especially SB).

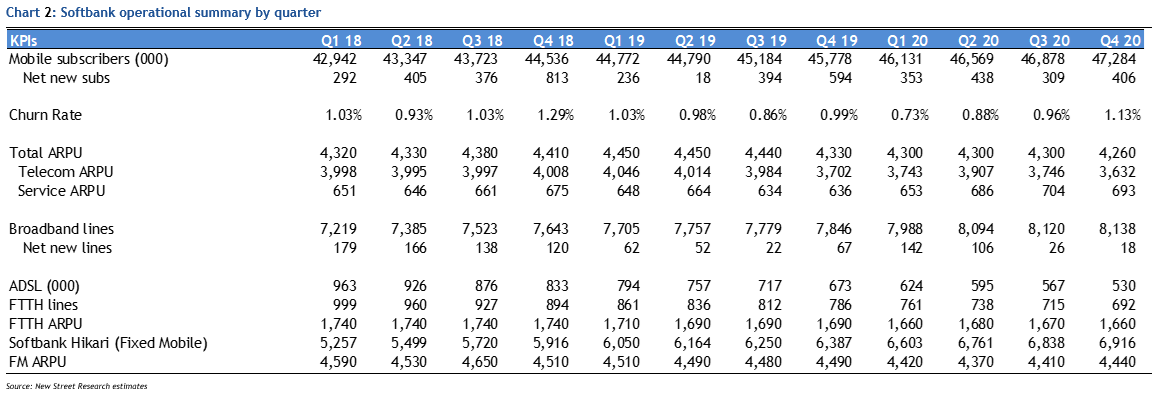

- Consumer mobile trends also improved, with MSR trends improving from -0.6% to +2.1%, driven by an improvement in ARPU from -6% to -1.9%. This is highly encouraging as the first quarter including new price plans, it suggests that neither price cuts nor improved Rakuten customer growth are having an impact on the mobile business. We think the reason is strong 5G take-up which acts to offset these twin pressures.

- Net profit on a reported YoY basis was up 57% on a YoY basis.

- Guidance for FY21 is strong. Revenue of ¥5.5trn compares to our forecast (and consensus) of ¥5.2trn, and implies top line growth of nearly 6%, after growth of 7% in FY 20. EBIT of ¥975bn compares to our forecast of ¥955bn (consensus ¥990bn) and Net profit of ¥500bn compares to our ¥488bn (consensus ¥496bn). The only negative in guidance is a flat dividend forecast at ¥86 whereas we expected an increase to ¥88.

Conclusion:

Figures were strong for SB KK, with strength in all business units. Most important are signs that mobile trends are (so far) unimpacted by either stronger Rakuten net adds or price cutting. We suspect this is because 5G upselling is offsetting these pressures. The market remains fundamentally bearish, we think, with most long only funds underweight. We think Softbank’s long term business model which relies on a much broader business focus than other telcos is likely to lead to market share gains and creates resilience to pressure in mobile, and enable the company to grow the top line medium term. We remain Buyers, and constructive on Japanese mobile generally. Our price target is ¥1,975.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.