TMUS/S: As Mississippi Goes, So Goes Mississippi

Earlier this week, Mississippi dropped out of the litigation against the proposed TMUS/S deal. Fox Business News reporter Charles Gasparino tweeted “@TMobile @sprint lawyers say more state AGs will join @MississippiAGO and drop from suit to block merger.” Are those lawyers right?[fnote]We can’t help but note that Mr. Gasparino’s business model apparently is to tweet out whatever the T-Mobile lawyers tell him. We respect that as a business model that might work for him (and he does look terrific on television) but if we followed that business model, we would have reported last December that the deal was about to wrap up at the FCC and DOJ with no further material conditions and with no risk of a state lawsuit and Mr. Legere would have said nice things about us on his February investor call. And we would have been wildly wrong. To be clear, we are not accusing any members of the T-Mobile team, who we deeply respect and who have done a great job, of misleading anyone. We simply wish to reiterate what we said when Mr. Legere criticized us in February for suggesting the deal had material obstacles to closing, that he and his team have their job—create an environment in which deal approval seems inevitable—and we have ours, which is to analyze public information to determine the probabilities of various outcomes. (LINK)[/fnote] Maybe, but we doubt it, for four related reasons.

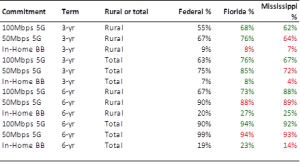

Mississippi didn’t get that good a deal from either a deployment perspective or an antitrust perspective. Last week, when Florida—which had not been part of the set of states litigating against the deal—settled with T-Mobile and joined the DOJ in supporting the deal, we explained why that deal was unlikely to move many others to settle (LINK). Mississippi joining with Florida does not really challenge that thesis or suggest to us a likelihood that there will be a settlement with enough states to either change the odds of the trial outcome or lead to a settlement before the trial begins. Mississippi presents something of a unique case, as discussed below, but as a preliminary matter, we note that Mississippi got an even worse deal than Florida and arguably worse than what the FCC negotiated for the nation as a whole. Florida got marginally better 5G coverage requirements than the FCC on a variety of metrics. Mississippi’s 5G coverage requirements are actually worse on most metrics compared FCC, thought the state got a big improvement on rural 100Mbps coverage in 6 years (FCC: 67%; MS: 88%)(See chart below). This is not surprising given the relative demographic and geographic advantages Florida has for deployment over Mississippi. But our point is that this deal, on its face, is not likely to cause any jealously in the hearts of policy makers in California, New York or the other more populous and wealthier states that remain in the litigation.

Further, as discussed before in our discussion of Florida’s deal, nothing in the settlement addresses the antitrust harms that were identified in the complaint. That is likely not a problem for the Mississippi Attorney General, but we think it would be for a number of others, as settling without resolving those antitrust problems would create problems for those Attorneys Generals down the road, as it would undercut their credibility in pursuing antitrust actions against others.

Federal vs. Florida vs. Mississippi 5G Buildout

Mississippi is unique among the states that were suing to block the deal in that it is the only one that voted heavily for Trump but has a Democratic Attorney General.[fnote]The states are New York, California, Colorado, Connecticut, Hawaii, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Nevada, Texas, Illinois, Virginia, Wisconsin, Oregon, the District of Columbia and Pennsylvania.[/fnote] If one is simply looking at the litigation in terms of national/state politics, the calculus is pretty simple. As they are doing in other areas, such as environmental law, Democratic Attorneys Generals in states that voted for Clinton suffer little downside and potentially enjoy much upside by suing to overrule a decision of a Trump agency. That is the case in most of the states in the litigation. In Michigan and Wisconsin, also both part of the litigation, Trump barely won and the 2018 election results and currently polling suggest a similar, though not as decisive, dynamic for those two attorneys generals. Texas is a special case, which we discuss below. Mississippi, however, is a special case, having gone for Trump by 17.8% but having, nonetheless, elected a Democratic attorney general. His political downside and upside are different than his fellow Democratic attorneys generals.

Mississippi is unique among the states that were suing to block in that it is the only one with an Attorney General currently running for Governor. To make matters even more unique, the Mississippi Attorney General, Jim Hood, is currently running in a competitive race for Governor. The election is November 5 of this year. Thus, Mr. Hood had an incentive to get whatever he could get for the state before that date. While other Attorneys Generals are likely to run for Governor, their time horizon in terms of accomplishments is longer term.

T-Mobile has been trying to turn states since they filed but have only turned one, and the cost of turning is going up with each legal filing, not down. Since the day that the states filed, we have heard a number of things, such as the states were bluffing, they don’t have the resources, they will withdraw once the DOJ is in favor, that the states won’t be able to get an injunction to stop the companies from closing and that they are all transactional and will settle. All of these things could have been true but we did not see the evidence for them and to date have not turned out to be so. We know that T-Mobile has had a full-throated effort to get states to turn since the filing and that it increased those efforts after the late July approval from the DOJ. So far the efforts have resulted only in Mississippi turning. As discussed above, we think that is something of a unique case. We also think that as the states make new filings,[fnote]We will discuss the states’ and other relevant filings this week in the Tunney Act Review proceeding in our weekend update.[/fnote] it becomes politically and psychologically harder to switch sides.

In addition, we note that Texas remains an interesting case. It is possible that the Texas Attorney General views the politics similarly to the Mississippi Attorney General and tries to strike a deal, but again, we doubt it. First, he is much more secure in Texas politics than Mr. Hood is in Mississippi politics. Second, his most important effort, in his own view, is leading the antitrust investigation into Google. Settling for some accelerated deployment would both undercut his political authority among his fellow attorneys generals, and it would also make him look both weak and transactional in a way that would undercut his ability to ultimately strike a legacy creating deal with Google.

We therefore continue to think the odds of settlement, or enough states leaving to change the odds at trial, as low. We think at this point the odds depend on the states’ sense of the strength of their case. We believe they believe it is more than strong enough to justify proceeding but we look forward to reading various pleadings from both sides to determine whether, in light of discovery, that remains the case.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.