TeleColumbus: Updated model post-Q1 results

TeleColumbus reported Q1 results last night – and for our detailed review of the quarter, please see our note HERE.

Now, following the management call, we publish an updated model to reflect the comments around the more competitive environment in the market. In this note, we run through our changes to estimates, liquidity and valuation.

Overview

As a result of the TeleColumbus first quarter results, we make two substantive changes to our model.

- A reduction in our Internet subscriber forecasts to reflect the more promotional market environment that the company is referring to

- A reduction in EBITDA margin to reflect the margin weakness seen in Q1 25

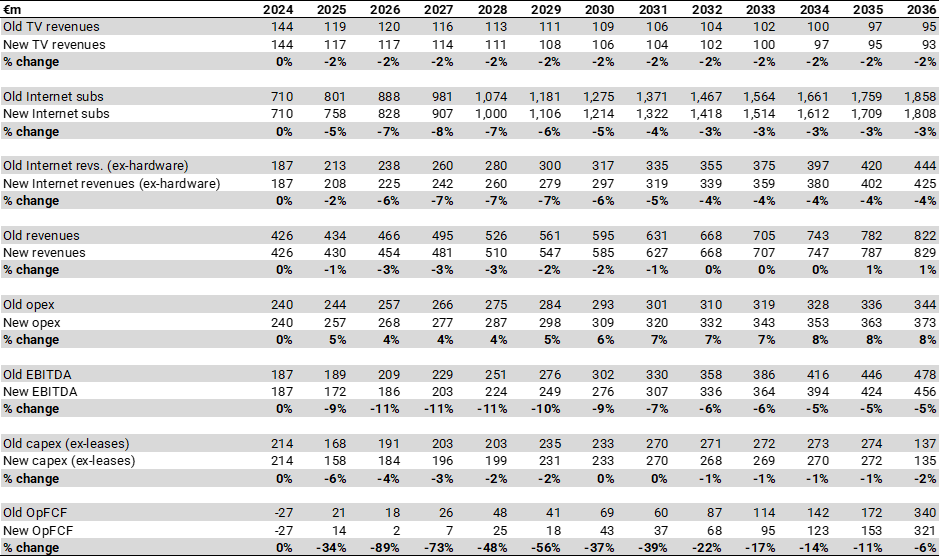

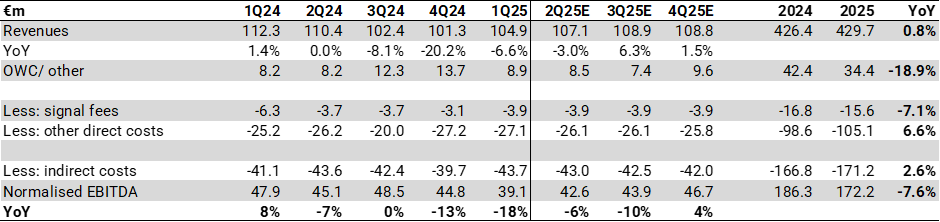

We summarise the changes we make to estimates here:

Changes to estimates

Given the change in disclosure on the Internet ARPU, the eagle-eyed reader will notice that above the change in TV revenues and the change in Internet revenues don’t add up to the change in total revenues. We believe that based on the new disclosure on hardware rental revenues, we had been underestimating the potential growth in that line item and this offsets some of the decline in the TV & retail Internet revenues. During 2024, TeleColumbus changed practice to charge equipment rental revenues to all products and also put through a price increase as well on the equipment revenue rental.

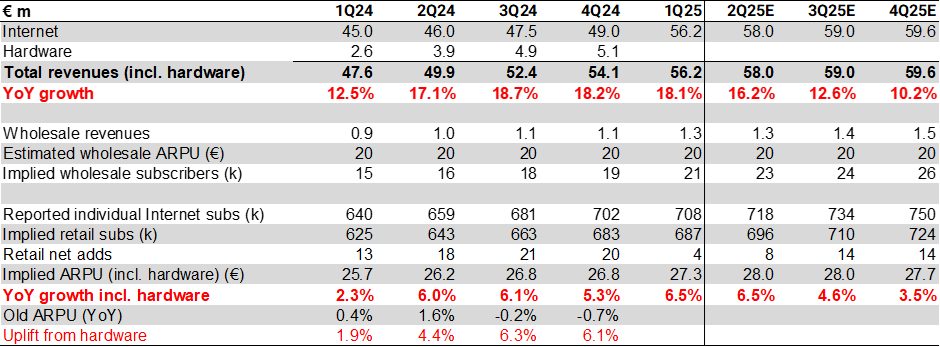

As a result, we provide below a more granular breakdown of the modelling over the rest of 2025 for the Internet revenues (including hardware). For Q2 25, TeleColumbus should still be able to benefit from the €2/ month February 2025 price increase for c.150k customers, which should add c.1pp to ARPU in Q1 (as already seen) and 1pp to ARPU in Q2. However in Q2, we assume that they also start to lap some of hardware ARPU increases, so this will dampen the blended ARPU trajectory over the remainder of the year.

Breakdown of Internet revenues through 2025

However, against this backdrop, the real question is what is happening in the market to make the environment more promotional, which the company referenced in the call and seems to be the main driver for their decision to withdraw current guidance for this year.

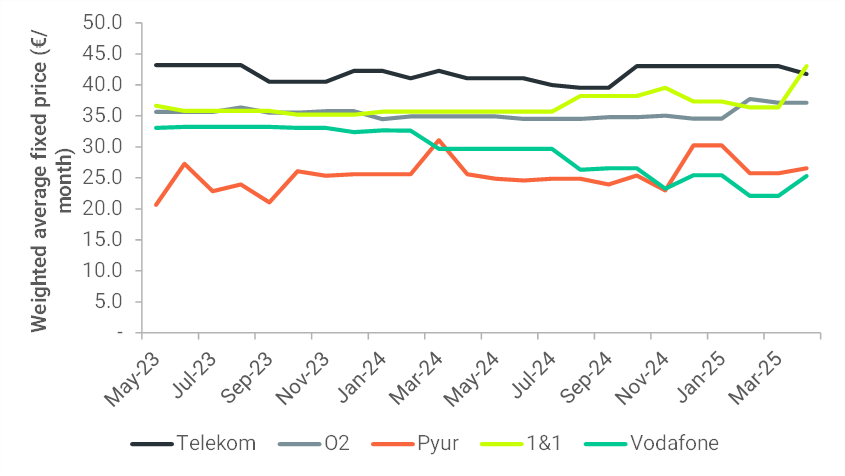

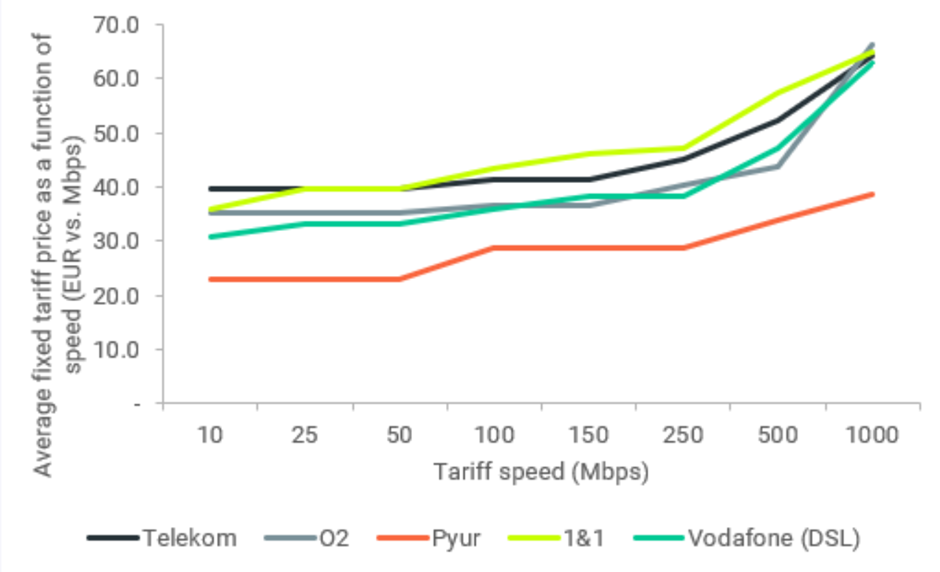

The intriguing point is that while the German mobile market has certainly seen intense competition, it appears to us that the spread of this competitive pricing into the fixed-line market has been far less. If we look at the blended prices of the main telecoms operators, with the exception of Vodafone (that focuses most of its efforts outside the TeleColumbus footprint), the blended prices of the operators have been fairly stable.

Blended German broadband prices

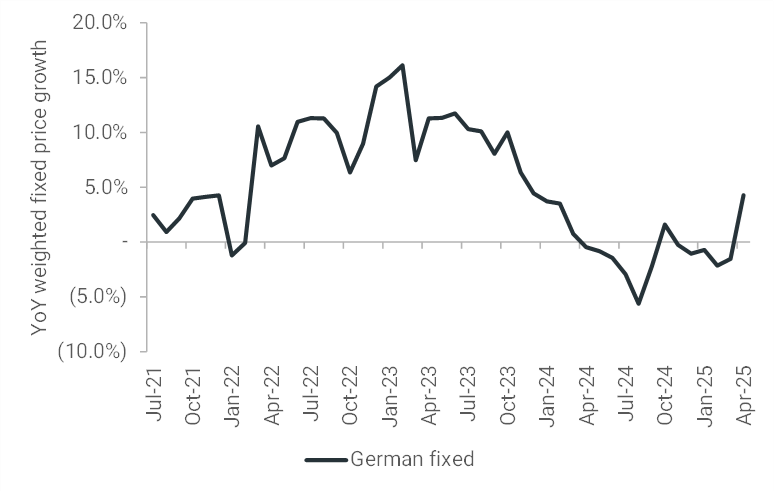

And if we look at the YoY trends in German fixed pricing, we see a broader improvement in headline pricing of late.

Headline prices YoY in German broadband have been more benign of late

Given that TeleColumbus’ standard prices remain more competitive than their main peers, we believe that the promotions in their area are likely to be more localised in nature, with door-to-door sales a key channel for broadband marketing in Germany. There could also be some impact from DT pushing their mobile family plans with multi-SIMs and this is causing some switching to DT broadband to take full advantage of cheaper mobile SIMs.

Therefore we assume that their retail adds in Q2 will also remain low as per the comments on the conference call, but after that their attractive headline pricing should still allow them to regain some subscriber momentum, albeit not at the rate seen in H2 24.

TeleColumbus’ headline pricing through still remains competitive

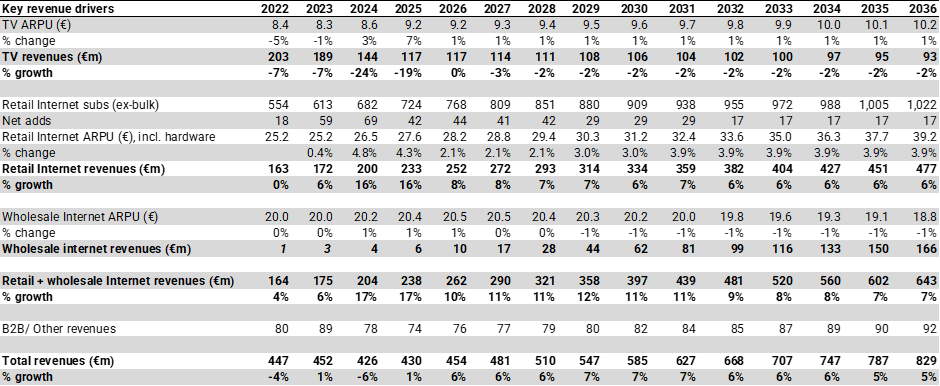

We then set out new revenue forecasts accordingly, in which we assume (as before) that the growth in their retail Internet KPIs will continue to fade over time, but this should be offset by their ability to grow wholesale revenues as they deploy more FTTH.

Of particular note for the longer-term thesis, on the recent DT earnings call DT mentioned (we believe publicly for the first time) that they would intend to wholebuy off TeleColumbus’s Level 4 cable network as it is built out. We do already include this longer-term upside from wholesale revenue growth in our model, but nonetheless it was encouraging to see DT affirm this.

Key drivers of revenues

Trying to model out the quarterly cost items for TeleColumbus in detail is difficult but we show below our assumptions which lead to a 7.6% decline in normalised EBITDA for 2025 against a revenue growth of +0.8%. Given the lack of guidance being given for EBITDA at the moment, it is also hard to get confidence in the outlook right now on the cost base, but we would assume that this decision reflects a concern for the profitability outlook for 2025.

We assume that given the company’s renewed focus on cost reduction, they are able to reduce some of their indirect costs, especially given their plan to try to reduce headcount.

In December 2024, TeleColumbus took a €6m provision for a planned reduction of 150 FTEs by December 2026, and we estimate that this could help to save them c.€6m/ annum which will phase in over the next 2 years.

Breakdown of 2025 EBITDA estimates

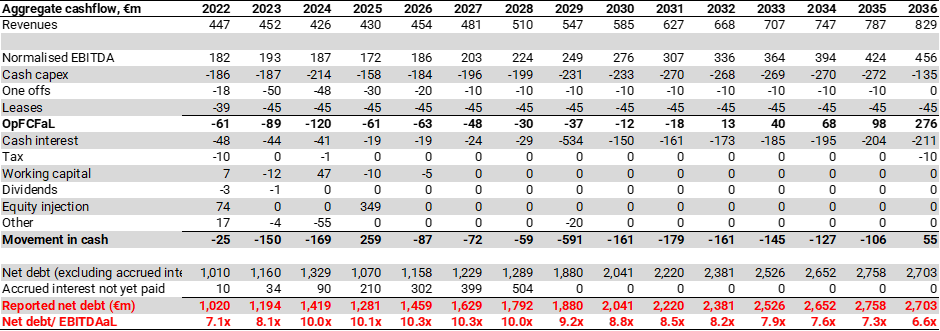

Where does this leave cash?

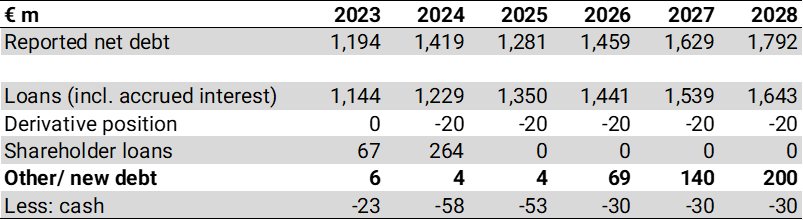

Based on this new outlook, we then lay out our more detailed cashflow forecasts below, absent any potential M&A, which implies that leverage will stay in the 9-10x range for the foreseeable future.

Summary cashflow forecasts

If we assume that TeleColumbus can run with a minimum cash balance of €30m, then our leverage forecasts above would assume that TeleColumbus will need to raise c.€200m in new financing, absent any M&A scenario.

For more specific thoughts though on a potential ServCo sale as a route to raise liquidity, please see our deep-dive note on that topic from last month: HERE.

New funding will be required over the current loan period

If the ServCo sale though can’t be done, they do have other options if they are able to find a willing third-party to help them with incremental financing:

- Raise a further €35m senior debt: The current debt documents allow for this incremental debt to be raised from a third-party

- Raise an additional €65m senior debt as long as there is an equal equity contribution, ie a total of €130m

These latter two steps could then provide an additional €165m of liquidity, assuming they can find willing private lenders.

- Lease financing through a third party of up to €160m: TeleColumbus could also look to use a third party to help build their L3/ L4 networks and buy them back at some point in future, and just lease the network for the time being – not entirely dissimilar to what Vodafone is doing with OXG. The current documents allow them to incur incremental lease liabilities of up to €160m.

Therefore in aggregate this could allow for an incremental €320m of financing.

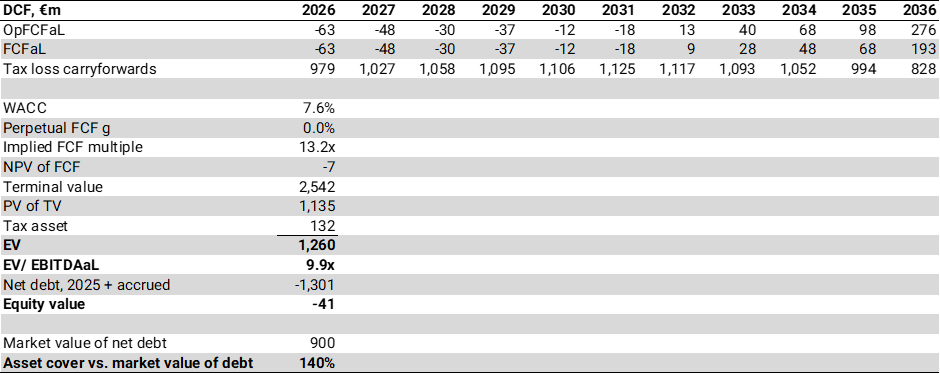

Reduction in valuation

On the back of the new estimates, we would no longer see the EV of €1.26bn (9.9x EBITDAaL) as fully covering the debt + the outstanding PIK interest (of €1.3bn at end 2025), albeit the gap is marginal.

However, of the €1.30bn of net debt (ex-IFRS derivatives), the face value of the loans is €1.1bn and these are currently trading at 79c. Therefore, with the market value of the debt at €900m, we see the asset cover as remaining an attractive 140% and still believe that despite this Q1 setback, the bonds still look attractively priced.

Revised valuation – with bond upside still attractive

Our full model is then available to download: HERE.