Liquid Intelligent Technologies (High Yield) – Q4 25: Decent quarter, still making progress on the second equity tranche and asset sale; call feedback included

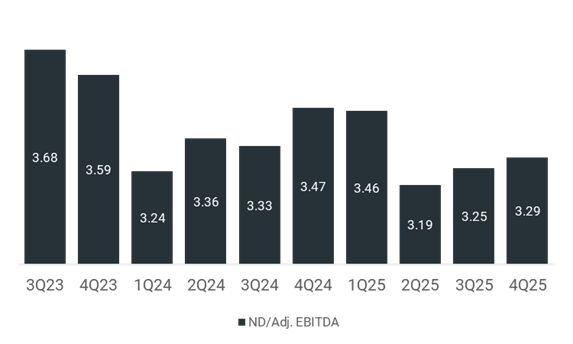

What’s new: Liquid has reported a decent set of Q4 results with underlying revenue trends improving and decent cash generation. Adj. EBITDA trends slowed further, as a result, net debt to LTM EBITDA slightly ticked up but it remains below the 3.50x covenant threshold. The company says it is making progress on the second equity tranche and the asset sale which will provide more relief and will also unlock the remainder $70m of the $220 new SA facility; it is also needed for the bond refinancing.

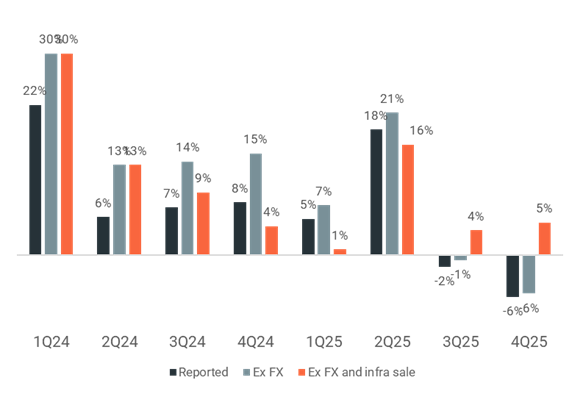

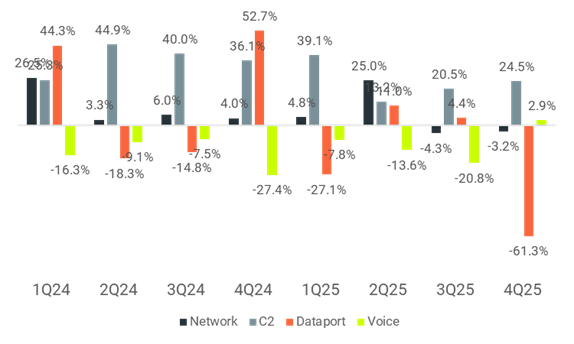

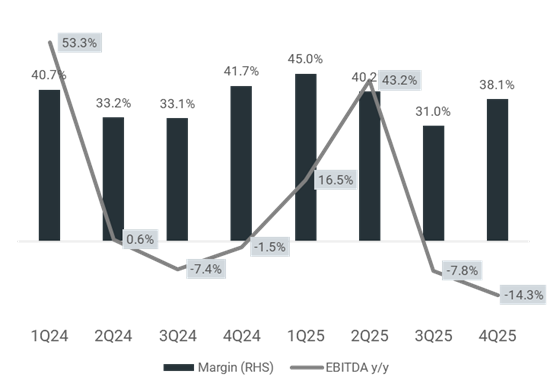

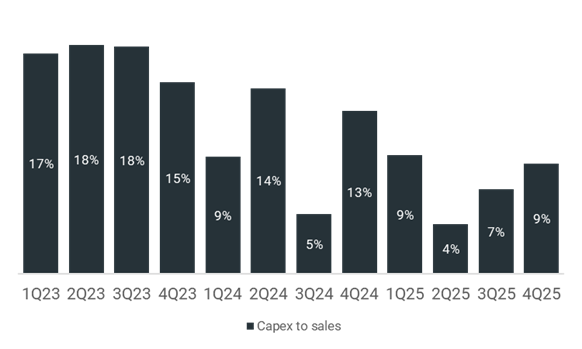

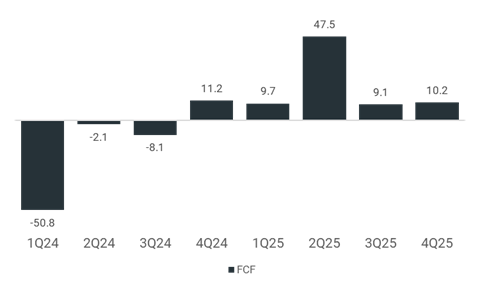

Operationally, Liquid saw revenue growth decline by 6.2% y/y from -1.7% y/y in the prior quarter, driven by lower Network and Data port revenue. This was on the back of tougher comparable from the $19.2m Eastern Cape Government (ECG) infrastructure sale last year. Excluding FX impact and the sale of infrastructure related to ECG, revenue would have grown by 4.7% YoY (Q1: 0.8%, Q2: 16.2%, Q3: 3.6%). Adjusted EBITDA declined by 14.3% y/y, impacted by higher staff costs and the non-recurrence of the non-cash provision movements from the prior year. In spite of this, FY25 EBITDA is still up 3% YoY. The company had previously commented on a further $15m of savings next year. Capex climbed slightly to $15.5m from $10.8m last quarter but FY spending of $50.3m came in - as we thought - below the $55-65m guide for this year. Capex was down by 37% YoY in Q4 which has helped mitigate the EBITDA this quarter. OpFCF was slightly below last year (-5% YoY) but FCF of $10m was roughly in line with Q4 24, and still positive.

FY26 guidance: With regard to revenue and Adj. EBITDA, the company targets “ good growth in local currency and more stable exchange rate levels / internal focus on USD revenue”. With regard to capex, the company is guiding for capex to be between $60m and $70m, we have $77m currently in our forecasts.

South African rand Term Loan refinancing and first equity tranche: As previously announced this year, Liquid managed to sign a new SA facility ($220m equivalent) which has enabled the signing and closing of the first equity tranche ($90m). $45m of the $90m first equity tranche went into the bond perimeter, of which $25m was used to pay down the RCF. For more on this, please see HERE. The new TL facility signed in December, will become usable once the remaining condition is satisfied (final equity CP), the company is working on that.

Second equity tranche of $135m equity: The company says it continues to make progress on the second equity tranche of $135m. The company had previously outlined that at least 50% of the equity financing ($225m in total) will go into the bond perimeter. If we were to assume $67.5m of the $135m equity raise was used to relieve its debt, this would imply a current net debt/EBITDA of ~3x (4Q25: 3.29x).

Key points from the call:

- Refinancing: The company highlighted it continues to make progress and execute on their plans and are still expecting to refinance the bond during Q3. The asset sale which is one of the keys to refinance and reduce the size of the new bond is taking longer than expected. However, the company has made good progress as the asset sale is moving towards completion with a preferred bidder and shareholders have approved that the majority of the proceeds will be used to reduce the debt. Liquid remains focused on refinancing its bond before it becomes a current liability (which would be in September this year) and the base case remains a full refinancing with a reduced size of not more than $450m. The TL refinancing was concluded in December 24 and final drawdown is pending the final equity tranche. The upsize of loan is conditional of an equity injection in the bond perimeter of $150m. The company is aiming to move away from a single maturity; to facilitate this, the new ZAR TL is multi-tenor, they aim to upsize the ZAR TL, reduce the size of the USD bond, and reduce overall debt. The company targets a net debt to EBITDA ratio of not more than 2.5x.

- Shareholder base: All shareholders sit at the Cassava level. In December, the capital table increased following investments received by the US DFC, Google and the finnfund. Also, the SA Public Investment Corp became a shareholder following conversion of its debt into equity. The company expects these enhancements in the shareholder structure to unlock value and help digital inclusion on the continent.

- On the operational side: The company continues to focus on monetisation the existing footprint with more targeted network densification. However, there are also pockets of expansion in Rwanda, Botswana, Zambia and in Uganda.

- Cash upstream: Generally speaking, the environment has been stable in term of upstreaming USD from all the markets including Zimbabwe, the flow of cash upstream has been steady .

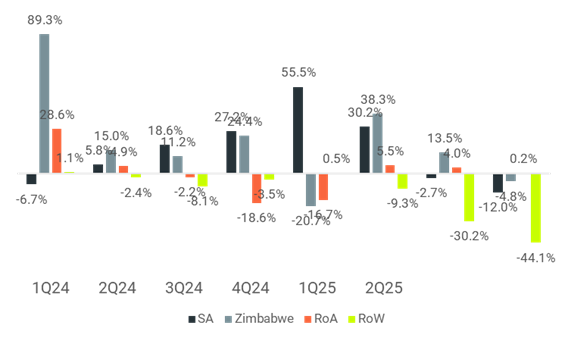

- Zimbabwe: Operations continue to grow in local terms with a high level of profitability and cash generation. However, the company has applied hyperinflation accounting given the weakening of the currency.

- DRC: The situation on the Eastern part of DRC remains fluid. 2 years ago the company did a significant build, to link the Eastern and Western parts of the country in order to connect to the West Africa undersea fibre cable. Management do not think the situation will be restored to normal by year end but one may be surprised to the upside. There has been some impact to revenue and EBITDA, impacts were fairly significant given hyperscalers use this fibre backbone.

Revenue: Solid underlying

KPIs were broadly solid, especially churn, which reduced to 0.4% vs. 0.43% last year (0.4% is the lowest point in the past 2 years). Fibre expansion in Q4 accelerated sequentially but remained relatively modest as the pan-continental network is largely complete (+427km vs. +355km in Q3). The monthly recurring revenue at 91% is slightly down sequentially (92% in Q3) but up y/y (71.4% Q4 24).

Excluding FX impact and the sale of infrastructure related to ECG, revenue was solid, slightly accelerating to 4.7% YoY from 3.6% in Q3.

Reported revenue growth

Reported revenue growth - Segments

We show below the revenue composition by regions.

Reported revenue growth - Regions

EBITDA: Impacted by higher overheads; decent margins

Gross profit increased by 10.5% YoY in Q4, but Adjusted EBITDA fell by 14.3% YoY from -7.8% in Q3 due to higher staff costs (inflationary pressure, especially in Zimbabwe) and positive other income in Q4 last year. On a FY basis, overhead and other costs were roughly flat, as the cost optimisation program helped mitigate impact from the inflationary pressures. Margins in Q4 were down by 3.6pp YoY to 38% but recovered nicely sequentially (Q3: 31%). Over time however, margins are expected to rise given the company had guided for an additional $15m in savings in FY26.

Capex: Low

Capex of $ 15.5m in Q4 implied total capex spend of $50.3m for FY25 which came below the $55-65m guide. As the build of our network is largely complete, a larger share of the capex was focused on customer connections compared to last year.

FCF: Still positive

Net leverage: Slightly up sequentially but down YoY

Net leverage slightly increased sequentially (+0.04x) but it reduced by 0.18x YoY to 3.29x as of end of Q4 25 and remains below the 3.5x covenant threshold.

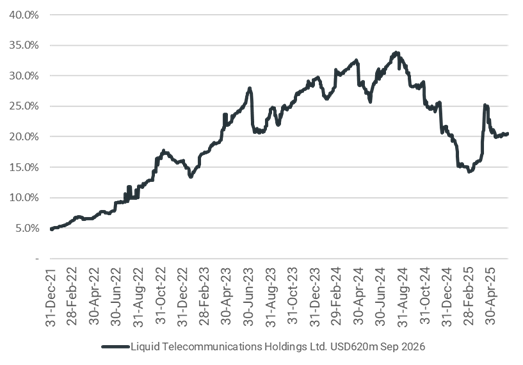

YTW evolution

Conclusion: At the time we launched coverage on Liquid our confidence in the companies’ ability to refinance successfully was not strong, although risk appeared mitigated by good asset cover. With strong operational progress this year, reduced leverage, and good progress on the new ZAR TL, our confidence has increased, while asset cover is if anything improving. The company needs to continue to execute on the asset sale and the second equity tranche. Despite the rally in Liquid bonds from the peak in July last year, it still looks undervalued we think.