Top Q’s and A’s for TMUS/S/DISH, C-Band, DBS merger, Techlash and Impeachment

In this week’s update we discuss the biggest questions of the week on the wireless merger (including on the impact of Florida joining the DOJ, the status of the FCC order, why the likely witness line-up helps the companies in litigation, and what is Softbank doing with Huawei), C-band (what is Senator Kennedy up to, what are the broadcasters up to, and why hasn’t CBA filed a new sales plan), a potential DBS deal (getting a big boost from Pai and maybe from an internal AT&T reorganization), Techlash (what the Zuckerberg/Warren press battle tells) and a few telecom policy implications from the DC focus on impeachment.

TMUS/S/DISH

Did Florida entry change the calculus for trial or settlement? This week Florida entered the case on the side of the DOJ and in effect, the companies. Prior to doing so, the state entered into an agreement with T-Mobile, with various commitments related to jobs, such as stores and customer experience centers, in-home broadband competition, disaster recovery efforts, and commitments related to deployment. We don’t believe Florida’s entry will have any impact on the outcome of the trial, as its entry does not affect the legal analysis, the antitrust facts or the judge’s perception of the relative merits.

A more interesting question is whether the deal Florida negotiated would tempt other states currently on the side opposing the merger, who presumably could obtain a similar deal, to bolt from their existing position and join the DOJ. It’s a possibility but we doubt any would. The commitments related jobs are pretty minor, the disaster recovery commitments sound like what might expect from any business operating in Florida, and the in-home broadband commitments are similar to what the companies promised the FCC.[fnote]As discussed in footnote 3 below, antitrust law does not view replacing competition in one market with competition in another as a valid antitrust trade.[/fnote]

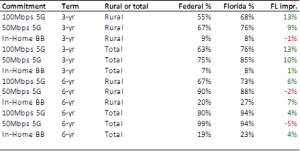

As to the commitments related to accelerated deployment, as the chart below demonstrates, Florida was able to obtain commitments to deploy that are, for the most part, better than those the FCC negotiated for the country at large. Still, we doubt such commitments will tempt others. The commitments are not that different and Florida, due to its flat geography and relative density, would probably obtain earlier deployments anyway, so the incentives to others may be even less.

But the most significant reason the Florida agreement is unlikely to move attorneys generals opposed to the deal is that Florida did not negotiate new conditions that relate to the antitrust harms identified in the states’ complaint. As Florida had not weighed in earlier in the process, it was not reversing itself. For a state that has signed a complaint identifying harms to competition to reverse itself on the basis of commitments noted above would seem unprincipled and political[fnote]We are not saying politics is irrelevant to the decision-making. We also recognize that pretty much everyone involved with this process has accused the other side of being unprincipled and political. And we are particularly amused (and in a way, impressed) by T-Mobile boosters who spoke with glee about how Pai moving first to approve would put Delrahim in a political box then accusing state officials of being political. But our point is that the state attorneys generals already committed to the case would need a lot more than what Florida got—including something directly related to competition—to switch positions.[/fnote] in a way that the attorney generals are not likely to see as in their interest.

5G Network Guarantees – Florida vs. Federal

When will FCC order come out and what are we looking for? We understand that Commissioner Carr registered his vote last week so we are looking for the order to come out the end of this week or the following week.

We are looking for two things. First, we are looking to see the kind of legal and factual arguments the majority and the dissenters make to determine the likely impact of the item at trial. For example, we expect it to have a lot of data about how the merger will lead to T-Mobile being competitive in the home broadband market.[fnote]We do not want to pass judgment on something before we read it but we can make two relevant observations on this part of the FCC order. First, as a matter of black letter antitrust law, improvement in competition in one product market (such as in home broadband) does not justify a lessening of competition in another product market (such as mobile broadband.) Second, our New Street colleagues, who have argued that regulators and the courts should approve the deal (LINK) are skeptical that the deal, in and of itself, would result in a material change in the in home broadband market. (LINK) We further note that T-Mobile just announced an in-home broadband test but the character of that test generally confirms our firm’s view that the market opportunity is relatively small.[/fnote] At this point, we believe that while the companies’ lawyers will cite it[fnote]One would hope they would, given the amount of time their lawyers spent after they had the votes meeting on it. Yes, it would be an exaggeration to say the company lawyers wrote the item. But not by much, as evidenced by the ex parte trail.[/fnote] often, it is not likely to be as important to the judge as other evidence. (See next question below, for example.)

Second, we are looking for how the Commission treats DISH. Here we expect some positive news for the company both in terms of how the Commission treats the company’s current obligations and how the Commission characterizes the company,[fnote]The FCC majority essentially wants to tell the court that DISH is likely to deploy a sufficient network to replace the competition lost by Sprint going away. To do that, they have to dismiss the allegations of, among others, T-Mobile. In this regard, we expect the item to follow the analysis already provided by our New Street colleagues as to DISH’s motives and opportunities. (LINK)[/fnote] which can be useful to the company in a variety of future contexts.

Given some of what you have written, why aren’t the odds even better for states? We give the states slightly better than even odds at winning at the trial. Some have noted that our legal analysis of litigating the fix (LINK) would suggest the odds for the states should be higher. We acknowledge that is a fair reading of our legal analysis.

The reason relates to how, at this point, we think the trial will rollout. Underneath the legal framework is a question that we believe the judge will constantly be asking himself: are American consumers better off in the long-run with the proposed DISH and T-Mobile business plans or are they better off with Sprint going through some kind of unspecified financial restructuring, sale of assets, and other business moves? At the trial, we believe Mr. Ergen and Mr. Legere will be compelling witnesses for the former. [fnote]Whatever one thinks of them, and we are big fans of both, everyone would have to acknowledge that they didn’t get to where they are without the ability to sell a story to a small audience. We have just finished Malcom Gladwell’s Talking to Strangers, which discusses why so humans do such a bad job judging the veracity of strangers. Embedded in Gladwell’s narrative and academic citations is the flip side, however, that some humans are particularly gifted at convincing strangers of their honesty and commitment to do what they say they are going to do. CEOs of publicly traded companies, particularly ones who started the company or took it to new heights have to have that quality.[/fnote] To the best of our knowledge, there will not be any businesspersons arguing in detail for the latter.[fnote]There will be expert testimony from economists and perhaps, peripheral testimony from business people but no one who will make the case for a Sprint as the Sprint executives will be making the opposite case. In this regard, the cross-examination of the Sprint executive may be a key part of the trial.[/fnote] That asymmetry, we believe, will be a major dynamic in the trial and the key reason we see the odds as closer than traditional antitrust analysis would suggest.

What is the relationship of the continued Administration push on Huawei and Huawei and Arm’s recent meeting? This question comes from reading two articles that appeared around the same time. The first was about how even impeachment is not slowing President Trump’s efforts to restrict Huawei’s ability to sell in the United States and other places in the world. The second reports on a closed door meeting between Huawei and Arm which resulted in a photo op designed to "’reaffirm the continuing cooperation among Arm, Arm China and Huawei,’ according to Arm.” The nature of that cooperation, as the article details, is complicated but from a national security and trade perspective, the important point is that Huawei is dependent on US Central Processing Unit technology from companies like Intel. Future versions of Arm may enable China to become independent, or even compete with Intel several years from now on server class processors. For our purposes, the question is relevant because Softbank, which owns 84% of Sprint, bought Arm before Trump was elected and then last year sold a majority share of Arm China to Chinese investors at what was considered a bargain price.

It should be noted that Softbank has essentially kicked Huawei out of Japan and Arm has cut Huawei off from obtaining its intellectual property. The question the article raises is whether the meeting represents a non-material public relations effort or suggests a reversal in the company’s anti-Huawei efforts. We don’t know how Administration personnel will view it. In a normal world, we would regard the trade, national security, and anti-trust issues as separate buckets and unlikely to leak into the other. But in this world, leakage (or if you prefer, linkage) is a common practice and wonder whether some Administration will take offense at what a Softbank affiliate is doing and threaten Softbank with a change in the DOJ position on the merger if Arm does not change its view of cooperating with Huawei. We see this as very unlikely, but many unlikely things have materialized recently,[fnote]Admit it. How many of you would have put chips on the ‘blaming Rick Perry for the “perfect” phone call that involved Trump asking for an investigation of corruption, as defined as a child of politician making money on foreign investments” card? Like we said, in this world, the unlikely has to be taken seriously.[/fnote] we thought the Arm/Huawei relationship becomes another low possibility scenario that nonetheless bears watching.

C-Band

What is the meaning of what Senator Kennedy is doing? Senator Kennedy this week announced that he had “secured language in the Financial Services and General Government Appropriations Act of 2020 that will free up C-band spectrum for 5G technology through a public auction." With respect to the Senator, we don’t see it that way. For one thing, the language is advisory to the FCC rather than binding on the FCC.[fnote]We understand the actual language is “The Committee encourages the FCC to prioritize resources toward exploring opportunities for spectrum to help accelerate the deployment of 5G to rural communities. The mid-band spectrum, specifically the C-band, is particularly well suited for 5G services. However, the Committee remains concerned by proposals that entail limited FCC oversight and public input, and contain no guarantee that taxpayers and the U.S. Treasury benefit from revenues generated by the sale of 5G licenses. The airwaves are a public resource, and the Federal Government has a responsibility to exercise appropriate oversight of its allocation. Therefore, the Committee encourages the FCC to conduct a public auction of the Cband spectrum that is fair, open, and transparent.” We think that the FCC could proceed with a CBA run auction under that language.[/fnote] For another, we understand it is not a done deal in terms of what the eventual legislation will say. For a third thing, the legislation may not happen until after the FCC releases its draft order.

So why would Kennedy say what he said? We can’t be certain but we believe he is trying to signal the FCC leadership that it has to satisfy him in terms of the auction process and the amount to the treasury or he will pursue a public relations campaign against the FCC plan. The FCC may decide to ignore that signal on the grounds that the Senate leadership has their back. That may well be true, but for our purposes, the important point is Senator Kennedy may not have a path to legislate but he does not appear to be going away.

Any other developments related to payments to CBA members? No, in the sense of news that happened, and yes, in the sense of news that didn’t happen. Let us explain.

The news that happened was that Eutelsat came out in favor of a significant contribution to the United States Treasury. We don’t regard this as significant as we had assumed they would or that, if they didn’t it wouldn’t matter anyway, as Eutelsat’s threat to litigate by itself was not a material risk to the FCC plan, whatever it eventually is.

The news that didn’t happen is that Chairman Pai continues to demonstrate that he either does not understand how to create leverage in his future negotiation with CBA[fnote]How might he do this? Well, since you asked we could think of a dozen tactics but let us suffice with three: (1) ask Thune and/or Wicker to gently criticize Commissioner O’Rielly’s recent comments that he doesn’t care about the amount the Treasury gets (LINK); (2) get the General Counsel to do a memo on weaknesses in CBA’s legal arguments, share it with the Commissioners and watch it leak; or (3) get someone on the White House staff to say that it is looking forward to getting at least as much money from the sale as it needs to complete the border wall. Blair confesses he did versions of all three while in government, they all worked, none of them required proficiency in Twitter, and it will take at least three beers before he will reveal details. Our point however, is that Pai shows no interest in such deal tactics and that is a good sign for CBA.[/fnote] or he does not care about creating leverage.[fnote]We are kinda shocked that Chairman Pai has not memorized his President’s magnum opus, The Art of the Deal, which advises "The best thing you can do is deal from strength, and leverage is the biggest strength you can have. Leverage is having something the other guy wants. Or better yet, needs. Or best of all, simply can't do without." Again, however, in a good sign for CBA, Pai either doesn’t know or doesn’t care.[/fnote] Either one is a good sign for CBA as, at least so far, it looks like they will be pushing an open door at the Commission in terms of defining the significant contribution. We note, however, that on this issue, things can change quickly.

What is the meaning of the most recent broadcaster filing? The most recent filing by a group of broadcasters raised the issue of “protecting their current use of the C-Band spectrum and the importance of that spectrum to their programming distribution and the reliance of the viewing public on the reliable delivery of video

programming arising from the use of the C-Band.” We understand the broadcasters are still arguing that 200 is the most that can be reallocated without causing harm to the program delivery, but we note the filing did not explicitly say that. Without going into the technical merits of the argument, we think the Commission leadership has made it very clear, both publically and privately, that they need to announce a plan with at least 300 Mhz. While the broadcasters are putting up a united front in the ex partes, we see some as interested in fighting all the way, including potentially suing if the FCC takes more spectrum, while others are interested in negotiating with the Commission to, overtime, enable the reallocation of 300 MHz

What is the meaning of the lack of a new CBA sales plan? Perhaps the most interesting thing that happened in C-Band this week is the thing that didn’t happen; a new filing by the CBA on how it intends to run a sales process. It is interesting to us because the staff seems to be trying to finish its work, as demonstrated by the technical details of some ex partes, but the current CBA plan for a single round, sealed bid auction, appears to be dead. So we would have thought CBA would be filing something that the FCC could approve of and address some of the concerns of Senator Kennedy, Commissioner Starks, and other stake holders who are arguing for a FCC run auction.

We see three possible explanations, in decreasing order of likeliness. First, CBA, unlike with its earlier plan, is taking pains to preview the plans with other stakeholders. That process is not yet done, but we should expect a plan soon. Second, CBA has decided that given the Chairman’s stated need to do something by the December meeting, it can afford to wait and file at the last minute, and the Chairman will have no choice but to accept its plan. Third, we are wrong and the original CBA auction plan is still alive at the Commission. If the first, which again, is what we think most likely, we would expect a new plan in the next two weeks.

DISH/DirecTV

Any new signals on a potential deal? Yes, but as will no doubt be true, the signals go in different directions. First, AT&T signaled that it had no interest in selling DirecTV. Second, AT&T brought back its former top policy executive, Jim Cicconi, who also brought back a number of members of his team. While we think this was largely due to general issues relating the operations of the DC office since Cicconi’s former deputy and successor, Robert Quinn, left,[fnote]A data point indicating that it is a general shake-up of the government affairs team, rather than a specific deal related move, is that Margaret Peterlin, former chief of staff to Secretary of State Rex Tillerson who joined AT&T last year and who some thought was positioned to step into the role that Cicconi and Quinn had, just left the company.[/fnote] It is hard to ignore Cicconi’s extensive experience in getting deals through DC decision makers.[fnote]While one can quibble with a close to, but not quite perfect record of success, we would simply say that if we were doing a deal, there is no one on the planet—heck, the universe--we would rather have in our corner for getting a deal done than Cicconi. His combination of smarts, connections and experience is unparalleled.[/fnote]

Third, and most important, is that Chairman Pai announced that the FCC at its meeting later this month will approve a petition by Charter to declare it is subject to effective competition in the Hawaii and Massachusetts communities that it serves due to competition from over-the-top streaming services. That means that the agency is now on record saying streaming video can be considered a competitor to the DBS providers. As we indicated in our earlier analysis (LINK), the government would eventually adopt this analysis, making it a lot easier for the two DBS providers to merge. It does not end the inquiry as opponents will raise the issue that there are relevant geographic markets where due to access issues, streaming cannot be considered a competitor. Further, the FCC judgment is not binding on the DOJ, the FTC, or the courts. But the FCC’s action is a big step forward, if the DBS companies wish to take advantage of it.

Techlash

Zuckerberg v. Warren: Who won this round and what does it mean going forward? In a week where almost nothing other than the topic of the next question was discussed, news of Mark Zuckerberg declaring Elizabeth Warren and potential antitrust case to break up Facebook an “existential threat” did get attention. Zuckerberg further said he would fight the battle in the courts. Warren responded "Imagine Facebook and Instagram trying to outdo each other to protect your privacy and keep misinformation out of your feed, instead of working together to sell your data, inundate you with misinformation, and undermine our election security.”

In terms of optics, this round goes to Warren who continues to be on a roll politically.[fnote]The political gods may be capricious but this week they were surely smiling on Warren, with great poll trends, excellent funding numbers, Trump’s attacks on Biden and Sanders’ heart attack. At some other time, if relevant, we will discuss why we think Wall Street’s fear of Warren will create a short-term buying opportunity but we think it is way too early for such speculation. (Let us take a moment to express gratitude to the Wall Street gods who at a similar point in 2007 kept us from hitting the send button on our outstanding, in-depth analysis of the likely impact of a John Edwards’ Presidency.)[/fnote] But antitrust battles are not won on twitter.[fnote]To be clear, we know that Senator Warren knows that. Presidential campaigns, on the other hand, apparently are won on that platform.[/fnote]Beyond the obvious lesson that CEOs should always defer questions about antitrust to their lawyers—other than to say “we remain laser focus on our customers and feel confident the courts will vindicate us”—we think the exchange demonstrates a few important lessons for investors. First, both sides will exaggerate the consequences. Even if a suit is brought and forces a break-up, that is far from existential. Similarly, if Facebook and Instagram were to be separate companies, there is no reason to assume they will compete for customers on the basis of privacy or keeping misinformation out of the feed.

Second, we think Zuckerberg and/or others will fight these efforts all the way to the Supreme Court, meaning that that institution, rather than others, should be where investors pay attention. In that regard, we remind our readers that the Court’s most recent antitrust decision is somewhere between good and great for the tech companies fighting antitrust efforts.

In addition, we note that Comcast is weighing in against Google, alleging that the search giant has taken steps to control the on-line ad market in ways that are anti-competitive. While some saw this move as a new step, in our view it is a continuation of a long-running battle between the edge applications and the ISPs. It does, however, indicate that the battle is something of a world war which will draw in everyone, as the government’s proposed remedies, whether eventually developed in courts, legislation or executive action, will affect the business models of every large entity transmitting bits or offering applications.

Impeachment Fever

How will the impeachment tide affects issues investors care about? Finally, we note that DC has been and is likely to continue to be obsessed over the path of impeachment, which we see playing out at least through 1Q20. We do see it have some mild impacts on issues we follow, such as:

- It is good news for CBA members as it lowers the risk of Congressional action against whatever Chairman Pai recommends;

- It is immaterial to the outcome of the TMUS/S/DISH trial, except for the possibility that news flow on the politicization of the DOJ further lowers the level of deference the judge wishes to assign to the DOJ;

- It will likely provide a short-term boost to techlash efforts as, at some point, the President is likely to lash out at some tech platform (most likely Facebook but potentially Google as well) for how they treat news he regards as “fake.” Investors should understand, however, that whatever that does in terms of the political battles will be more than offset by the many ways Facebook and Google monetize both millions to be spent on impeachment related advertising and how it improves the efficiency of those platforms for the big spend in the 2020 general election.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, 18th Floor, 100 Bishopsgate, London, EC2N 4AG. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.