Verizon / Frontier: How much can Verizon pay

What’s new: we provided our most comprehensive thoughts on Verizon’s proposed acquisition of Frontier in a call last week (SLIDES; REPLAY). We published a subsequent report arguing that Frontier investors ought to demand a higher price (HERE). In this report, we explore how much Verizon can pay, with the deal still being accretive to value for Verizon shareholders. We conclude that Verizon can afford to pay a much higher price.

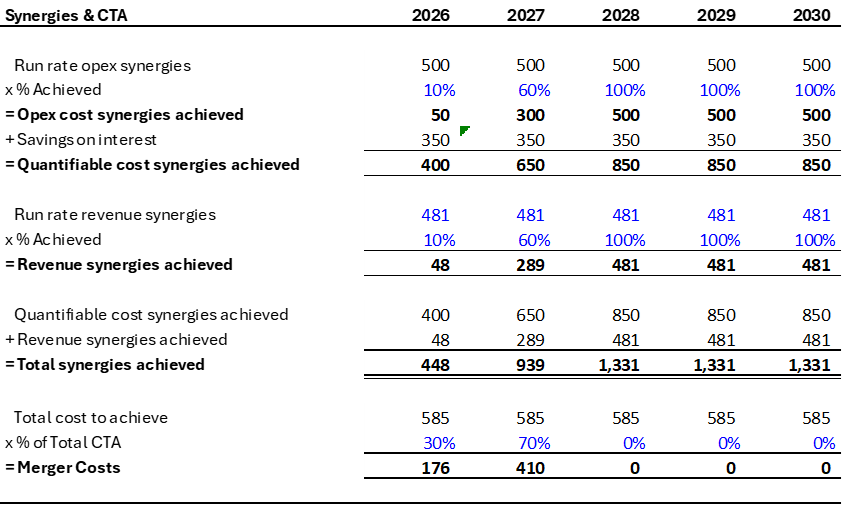

Synergies

Verizon has guided to synergies of $500MM, captured over three years. We assume the deal closes at the end of 2025, which would mean synergies are fully captured in 2028.

We estimate an incremental $350MM in savings from refinancing Frontier’s debt at Verizon’s cost of debt. There would be tax savings from the acceleration of Frontier’s NOLs, which we haven’t quantified yet. This brings total quantified cost synergies to at least $850MM by 2028.

In our prior note (see slide 10), we quantified revenue synergies of ~$480MM, based on Verizon’s disclosure of churn impacts and higher share in converged markets. We generally don’t include revenue synergies when we underwrite deals, but the Companies often do. If Verizon needs to justify a higher price to investors, they can fall back on these revenue synergies.

We assume cost to achieve of $585MM, including $500MM to achieve opex synergies and $85MM in premiums paid to exchange Frontier debt.

Thresholds

Companies will generally do deals that are accretive once synergies are fully realized. When doing merger analysis, we will generally look at accretion / dilution two ways: we will either look at current earnings and FCF, proforma for full cost synergies, or we will look at earnings and FCF in the year the synergies are realized. Verizon doesn’t grow much, and so the two approaches yield similar results.

In this note, we will focus on accretion / dilution in 2028, the year that synergies are fully realized. Our rough rule of thumb: if it is neutral to FCF in 2028, the Company is paying full price; if it’s dilutive, they are overpaying; if it is accretive, they are capturing value for their shareholders.

The value we are focused on here is the value that Verizon can afford to part with. This isn’t the same as intrinsic value. Verizon could pay less than the intrinsic value of the asset and it could still be dilutive. This note is focused on what Verizon can pay rather than intrinsic value. See this report for valuation analysis based on trading and transaction comps (LINK).

We also assume leverage is a threshold. In the current deal, Verizon dips below 2x leverage at the end of 2028. We assume they must be at 2x by the end of 2028. This doesn’t impact what they can pay, but it does impact the mix of cash and stock.

Scenarios

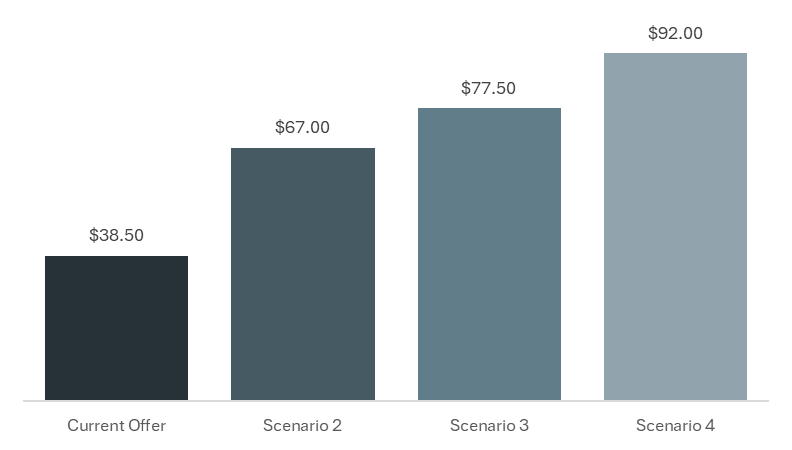

We explored four scenarios:

- $38.50: the current offer

- $67.00: the price at which the deal is breakeven on FCF per share in 2028 assuming management’s synergies of $500MM.

- $77.50: the price at which the deal is breakeven on FCF per share in 2028 assuming our synergies of $850MM (opex synergies plus interest savings).

- $92.00: the price at which the deal is breakeven on FCF per share in 2028 assuming management’s synergies of $500MM, interest savings of $350MM, and revenue synergies of ~$480MM.

We believe Frontier investors and the board ought to at least demand $67. Verizon could comfortably afford up to $77.50. They could justify up to $92 in a desperate fight with other bidders, but they probably shouldn’t.

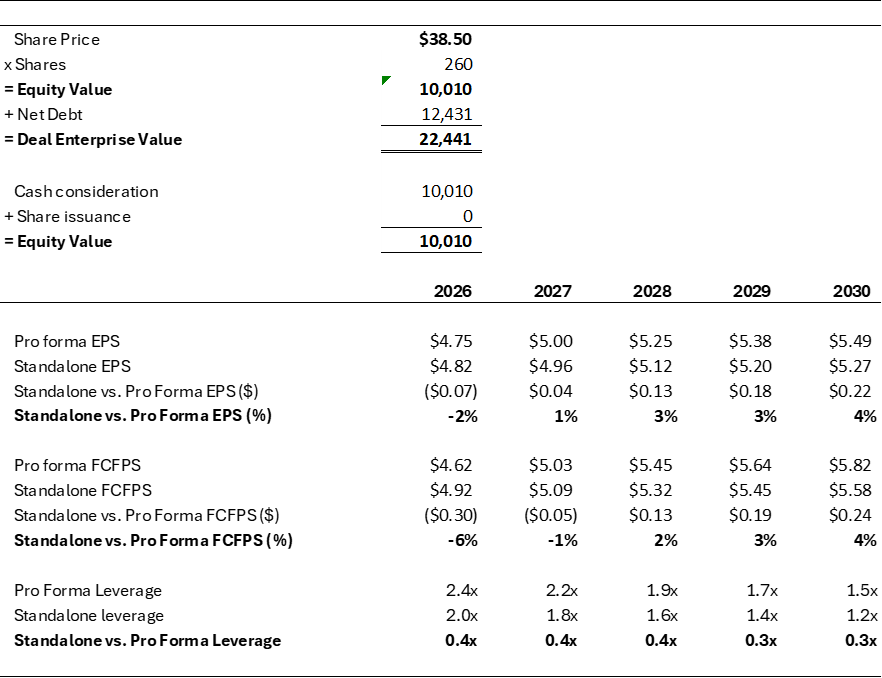

Scenario 1: $38.50 per share, all cash (the current deal)

At $38.50, Verizon is buying Frontier equity for $10BN. After absorbing $12BN of debt, the total deal is valued at $22BN (this is net debt at closing, which is $2BN higher than current net debt). The $22BN increases Verizon leverage by 0.4x. The deal is accretive to free cash flow per share starting in 2028, assuming the deal closes at the end of 2025.

Scenario 2: $67.00 per share, cash and stock

Assuming just management’s $500MM in synergies, the transaction would be neutral to FCF per share in 2028 at $67.00 per share. Based on our simple framework, anything above that would be bad for Verizon’s shareholders and anything below that would be good. At $67.00, the deal is worth $30BN.

We assumed Verizon wants to be at 2.0x leverage by the end of 2028. As they push the price higher, they would have to include some stock as part of the consideration to meet the leverage target (they may choose to use all cash and accept higher leverage; our approach is conservative, as using stock erodes the accretion).

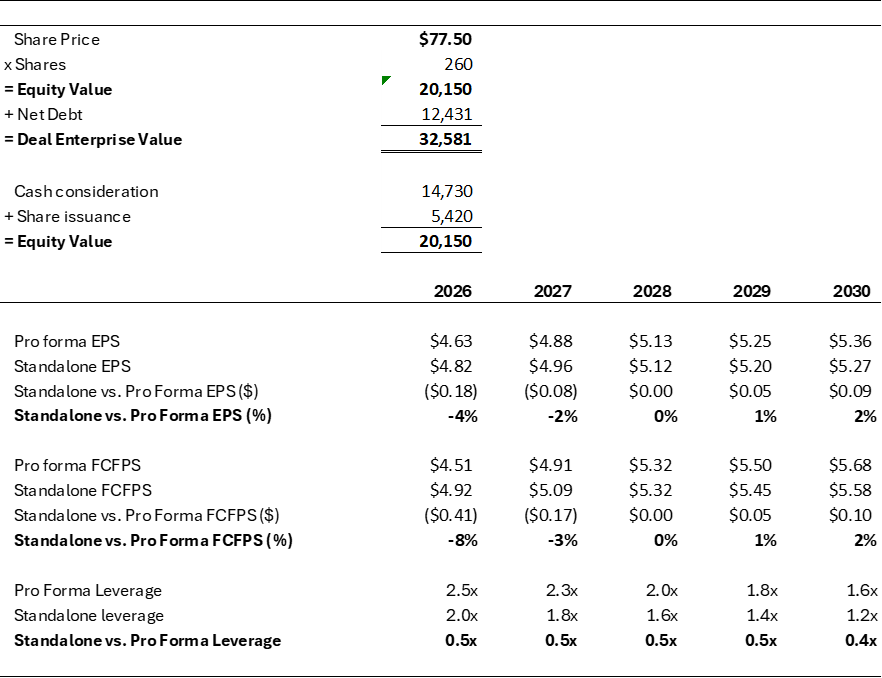

Scenario 3: $77.50 per share, cash and stock

In this scenario, we include the interest savings that Verizon extracts from exchanging Frontier’s debt. We’ve quantified these at $350MM. With $850MM of synergies, Verizon can pay $77.50 per share for Frontier, a 101% premium to the current offer. At $77.50, Frontier is worth $33BN.

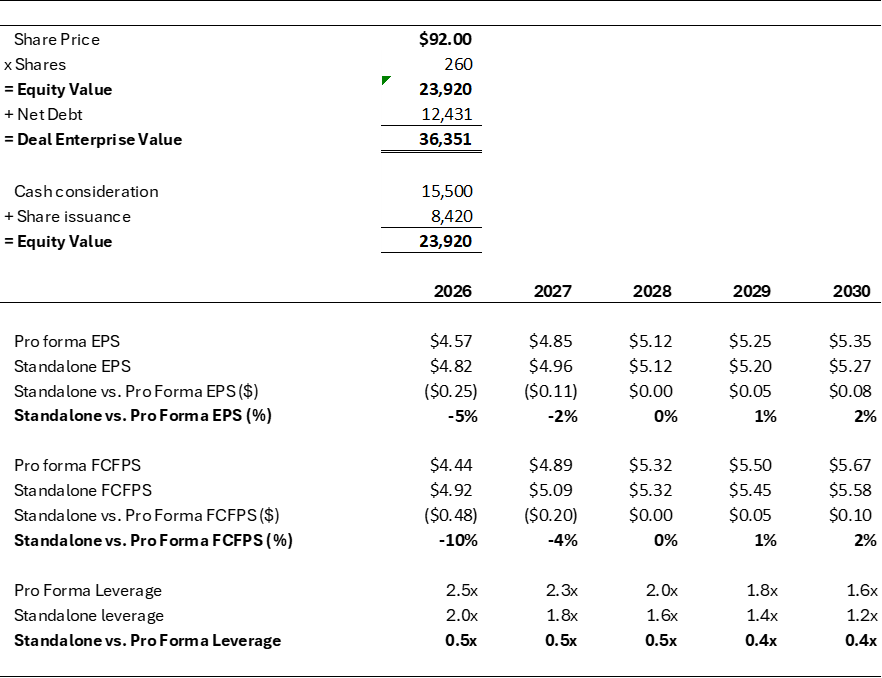

Scenario 4: $92 per share, cash and stock

In this scenario, we include revenue synergies of $480MM derived from the higher penetration and lower churn that management spoke to. This takes total synergies to $1.3BN. With this quantum of synergies, the transaction would be breakeven on 2028 FCF per share at a price of $92. This would value Frontier at $36BN.

As mentioned above, we generally regard revenue synergies as speculative, and we regard these ones as particularly speculative. The Company shouldn’t pay for these. The deal starts to become of questionable financial benefit to Verizon shareholders above $77.50, in our view. However, if a bidding war starts, and Verizon views this as a must-have strategic asset, they could justify a price up to $92.

More stuff

A replay of our conference call is HERE. Slides are HERE.

Our note on why investors ought to demand a higher price is HERE.

Blair’s note on the regulatory prospects is HERE.

Our thoughts on the deal Verizon (and AT&T) should do next is HERE.

Our quick thoughts following the merger call is HERE.

Our quick take following deal rumors from the perspective of Verizon owners is HERE.

Our quick take following deal rumors from the perspective of Frontier owners is HERE.

Full 12-month historical recommendation changes are available on request

Reports produced by New Street Research LLP, Birchin Court, 20 Birchin Lane, London, EC3V 9DU. Tel: +44 20 7375 9111.

New Street Research LLP is authorised and regulated in the UK by the Financial Conduct Authority and is registered in the United States with the Securities and Exchange Commission as a foreign investment adviser.

Regulatory Disclosures: This research is directed only at persons classified as Professional Clients under the rules of the Financial Conduct Authority (‘FCA’), and must not be re-distributed to Retail Clients as defined in the rules of the FCA.

This research is for our clients only. It is based on current public information which we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. We seek to update our research as appropriate, but various regulations may prevent us from doing so. Most of our reports are published at irregular intervals as appropriate in the analyst's judgment. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

All our research reports are disseminated and available to all clients simultaneously through electronic publication to our website.

New Street Research LLC is neither a registered investment advisor nor a broker/dealer. Subscribers and/or readers are advised that the information contained in this report is not to be construed or relied upon as investment, tax planning, accounting and/or legal advice, nor is it to be construed in any way as a recommendation to buy or sell any security or any other form of investment. All opinions, analyses and information contained herein is based upon sources believed to be reliable and is written in good faith, but no representation or warranty of any kind, express or implied, is made herein concerning any investment, tax, accounting and/or legal matter or the accuracy, completeness, correctness, timeliness and/or appropriateness of any of the information contained herein. Subscribers and/or readers are further advised that the Company does not necessarily update the information and/or opinions set forth in this and/or any subsequent version of this report. Readers are urged to consult with their own independent professional advisors with respect to any matter herein. All information contained herein and/or this website should be independently verified.

All research is issued under the regulatory oversight of New Street Research LLP.

Copyright © New Street Research LLP

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of New Street Research LLP.